Step 10: Execute Post Acquisition Integration

In this step, we answer common FAQs about acquisition and integration and provide best practices, playbooks, articles, and presentations that will help you:

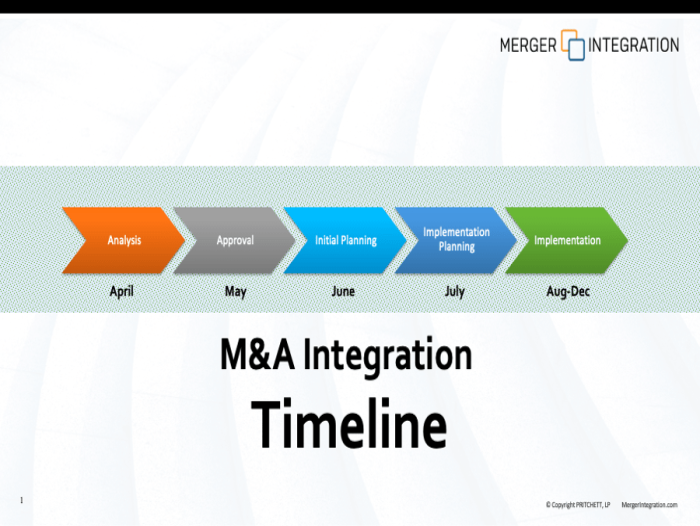

- Execute your acquisition integration strategy expeditiously

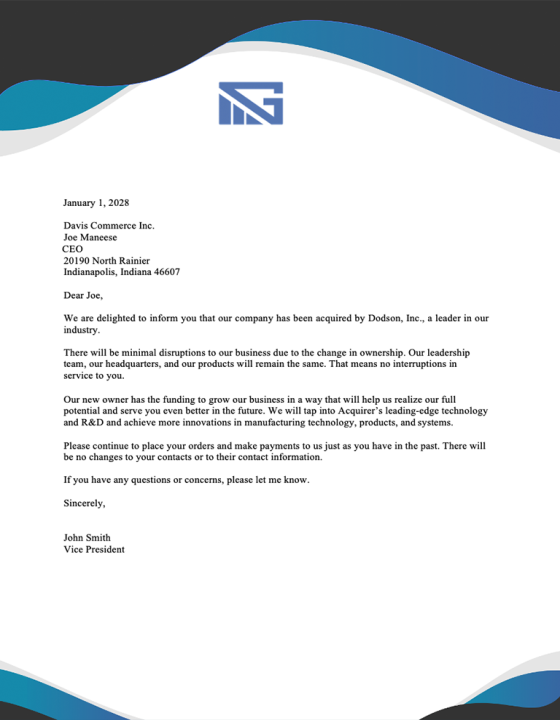

- Communicate effectively to stakeholders on Day 1 and thereafter

- Achieve early wins

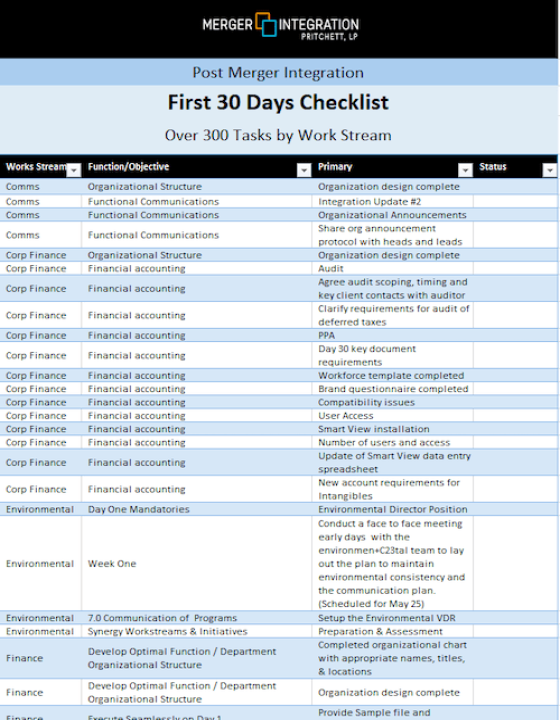

Plus, we offer tools that will help you track results against plans, synergies and milestones achieved to date, activities to be completed, and unresolved issues. We also cover how to close out your Integration Management Office and transition any remaining long tail integration activities to business line leaders.