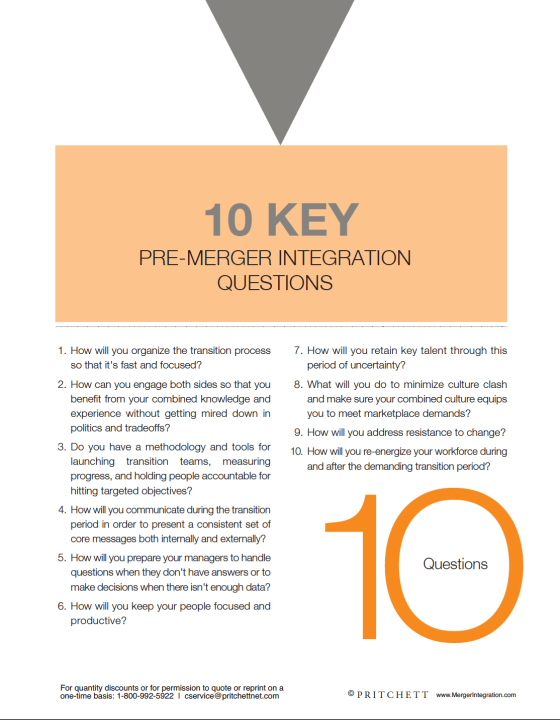

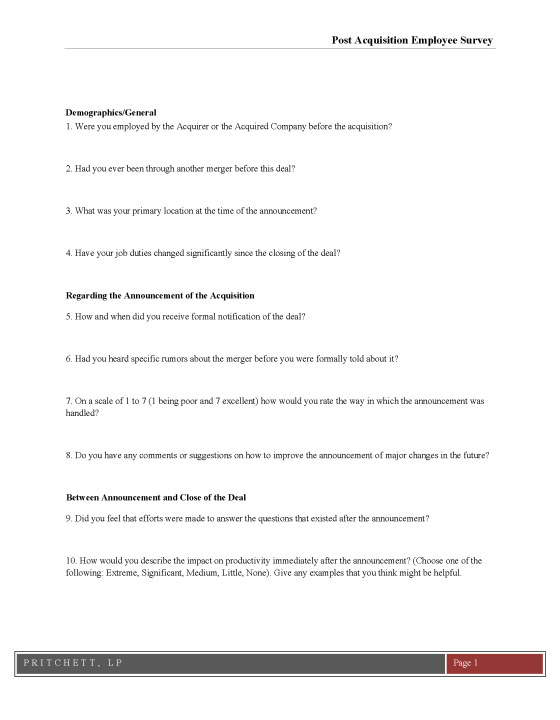

Scroll down to review the free insightful, downloadable M&A articles that include many of the most influential pieces ever written on M&A.

PRITCHETT Merger Integration Certification Workshop Attendees and Website Subscribers can access all the articles plus all the presentations, playbooks, books, checklists, case studies, assessments, webinars, research, videos, tools, and templates on MergerIntegration.com.