Content

- Why Acquired Co.

- Market Strength / The People

- Combined Strength

- Acquired Co. Overview

- Strategy for The Future

- Opportunities for Employees

- Merger Timeline

- More Information

- What Has Been Determined

- Summary

Why Acquired Co.

- Expansion in the North American Market

- Global Service Offerings

- Continue to the Path of Product Independence

Market Strength and People

Market Strength:

- High customer satisfaction

- Strong domestic customer base

- Geographic coverage in US

- Robust service offerings

- Many customers with international operations

- Brand recognition

- Product independence

The People:

- 5,000 professionals that are close to the customer

- Sound sales organization

- Excellent range of technical skills

- Exceptional customer service philosophy

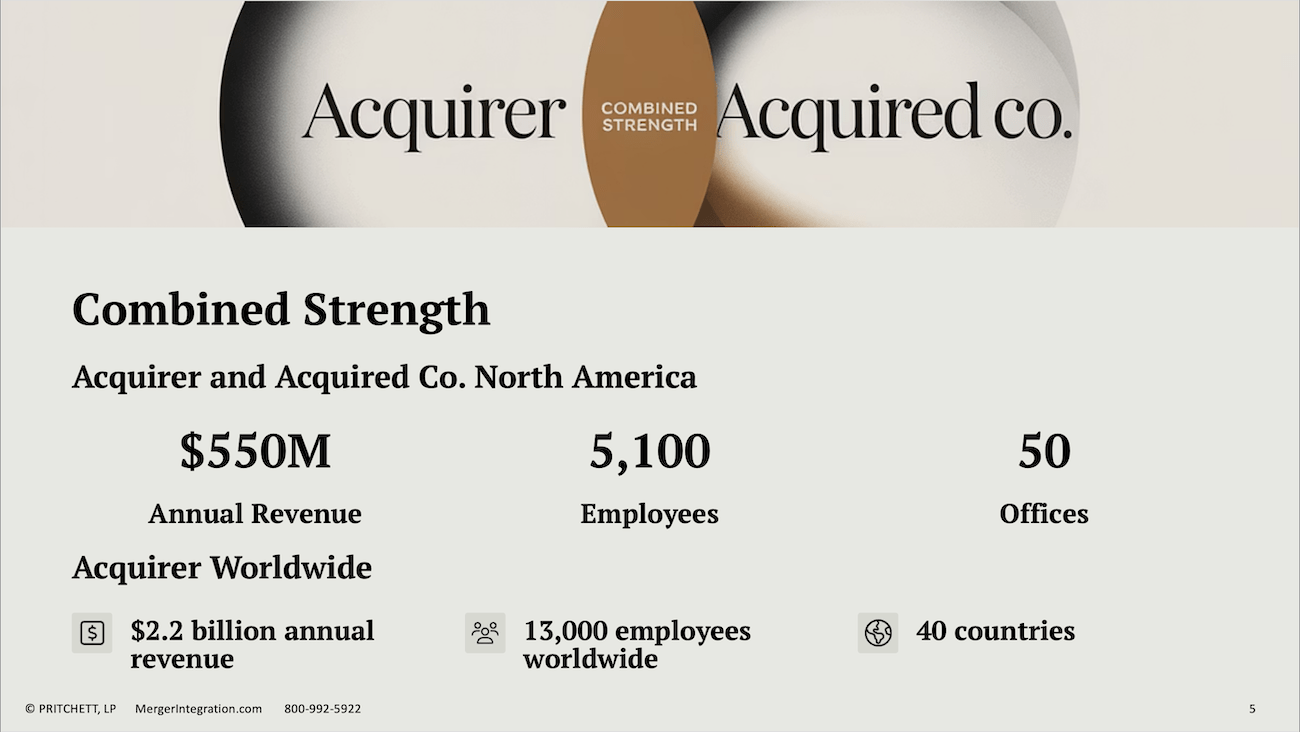

Combined Strength

Acquirer and Acquired Co. North America

Acquirer Worldwide

$2.2 billion annual revenue

13,000 employees worldwide

40 countries

Acquired Co. Overview

Company Profile

- $500 Million in Revenue

- 50 Locations

- 38% of Fortune 100 as Customers

Service Offerings:

- Network design

- Network management

- Help desk-desktop support

- Outsourcing services

- E-business services

- Project management

Strategy for the Future - North America

A US organization with a strong international orientation

US-focused organization

- Broader range of services and platforms

- Ability to expand service offering to customer base

- Product independent position

At the same time

International business

The combination of Acquirer and Acquired Co. offers the opportunity to provide customers with international operations and consistent services across Europe and North America

Opportunities for Employees

- Long-term Commitment: Major investment in this market confirms Acquirer's long-term commitment to North America

- Expanding Opportunities: Expanding opportunities beyond Acquirer's products

- Larger Organization: Part of a larger service organization

- Mission Critical: Continued commitment to the mission-critical business

- Expansion Potential: Expansion into Acquired Co's customer base with consulting services and e-business offerings

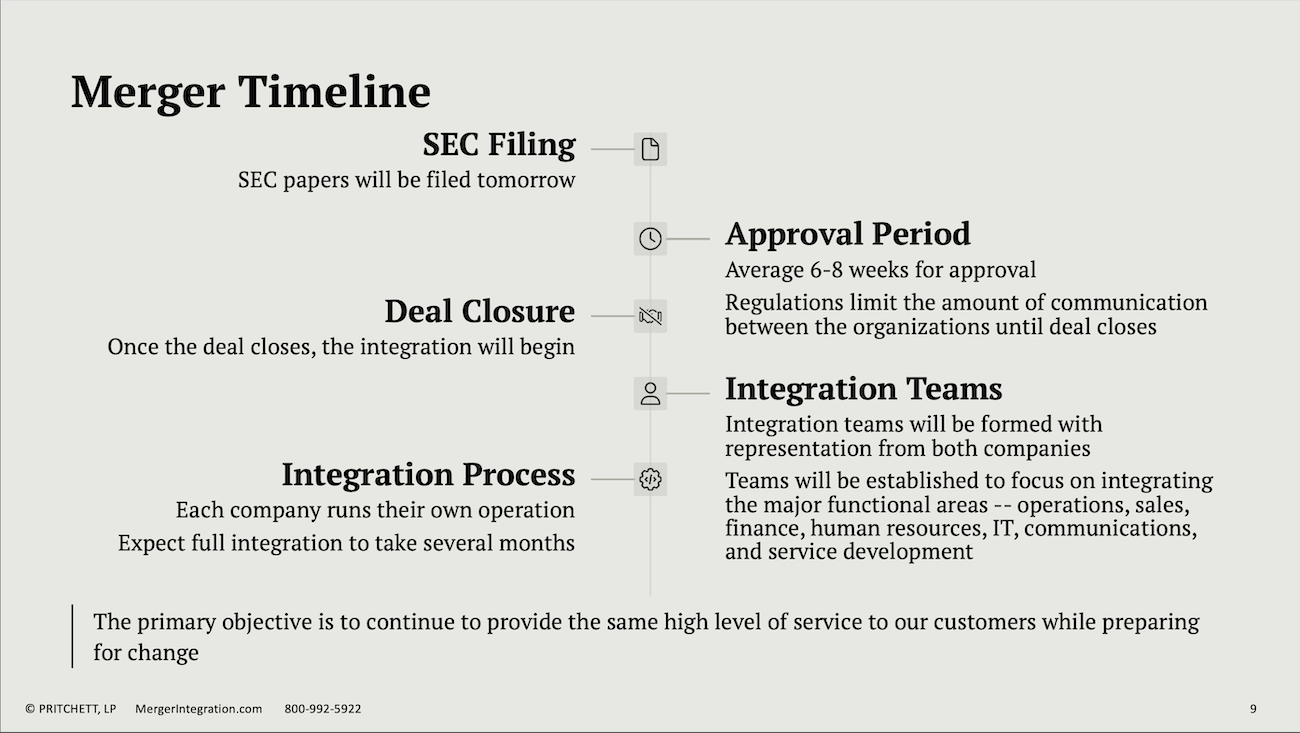

Merger Timeline

SEC papers will be filed tomorrow

Average 6-8 weeks for approval. Regulations limit the amount of communication between the organizations until deal closes.

Once the deal closes, the integration will begin.

Integration teams will be formed with representation from both companies. Teams will be established to focus on integrating the major functional areas -- operations, sales, finance, human resources, IT, communications, and service development.

Each company runs their own operation. Expect full integration to take several months.

The primary objective is to continue to provide the same high level of service to our customers while preparing for change.

More Information...

Current Information Status

- Limited amount of information to share today

- After the deal closes, more answers will be available regarding the integration

Question Process

- Funnel your questions to your local management team

Information Access

- Any information that can be shared will be posted on our intranet

What Has Been Determined

Benefits & Compensation

No changes will occur to benefits & compensation this year.

Operational Structure

Acquirer North America will merge into the Acquired Co. operation.

Legal Structure

Acquired Co. will remain a separate legal entity within the Acquirer.

Summary

Our Goal

To grow the integrated company

Our Vision

Become one of the major players in the information services market

Our Approach

We all need to work well together to achieve our goal