The 5 Types of Integration

The Phases in the Post-Merger Integration Process

The Steps in the Post-Merger Integration Process

The Typical Post-Merger Integration Teams

The Responsibilities of the Integration Management Office

The Responsibilities of the Functional Integration Team Leaders

The Qualities of an Effective Post-Merger Integration Leader

Ten Post-Merger Integration Best Practices

The Usual Post-Merger Integration Costs

Post-Merger Integration Challenges and How to Address Them

The Most Common Post-Merger Integration Risks

The Reasons Mergers Fail

The 18 Areas Executives Should Agree on Before Integration Planning Begins

What Should Be Prepared for M&A Day 1?

Example of M&A Day 1 Communications Plan

Example of M&A Integration Timeline

Meaning of Jump the Gun

Common M&A Success Metrics

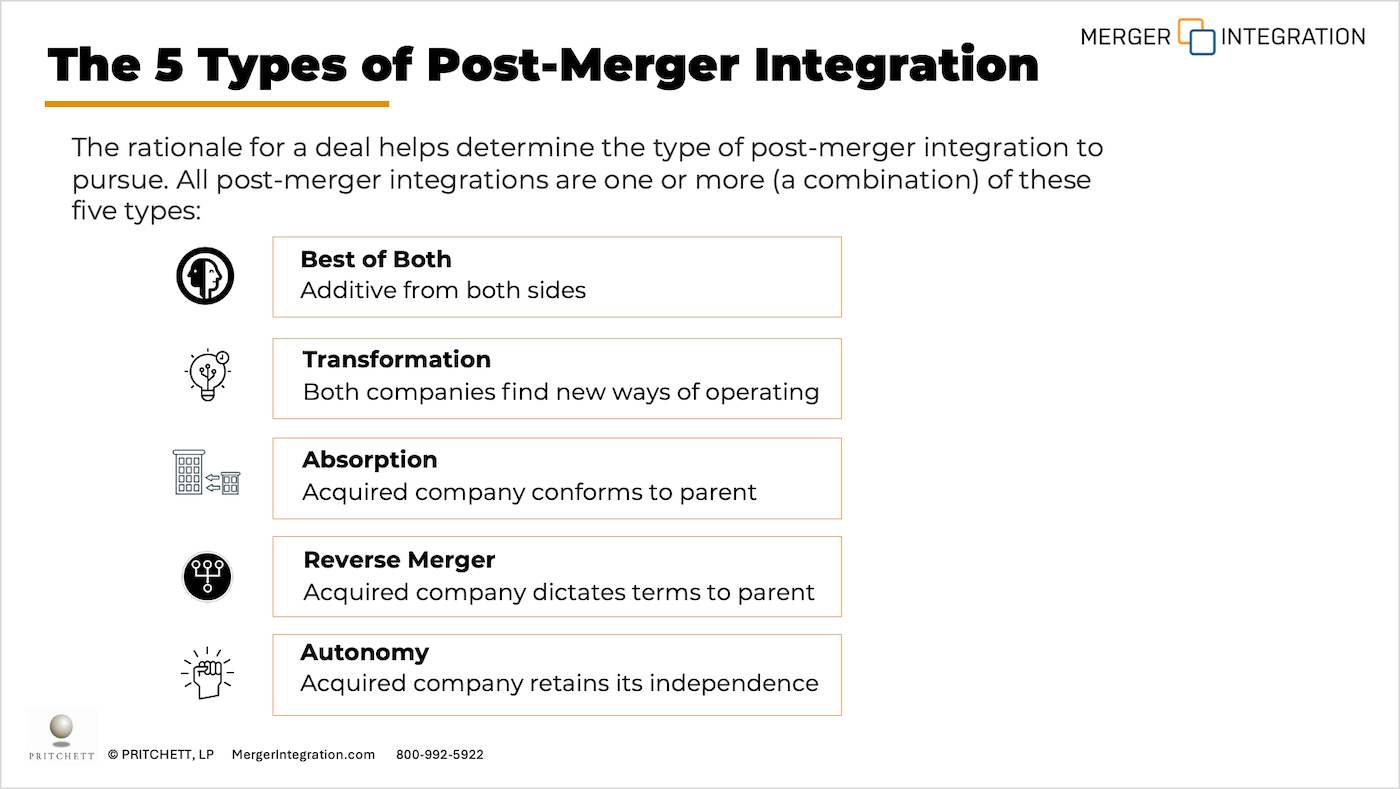

The 5 Types of Integration

The rationale for a deal helps determine the type of post-merger integration to pursue. All post-merger integrations are one or more (a combination) of these five types:

-

Best of Both

Additive from both sides -

Transformation

Both companies find new ways of operating -

Absorption

Acquired company conforms to parent -

Reverse Merger

Acquired company dictates terms to parent -

Autonomy

Acquired company retains its independence

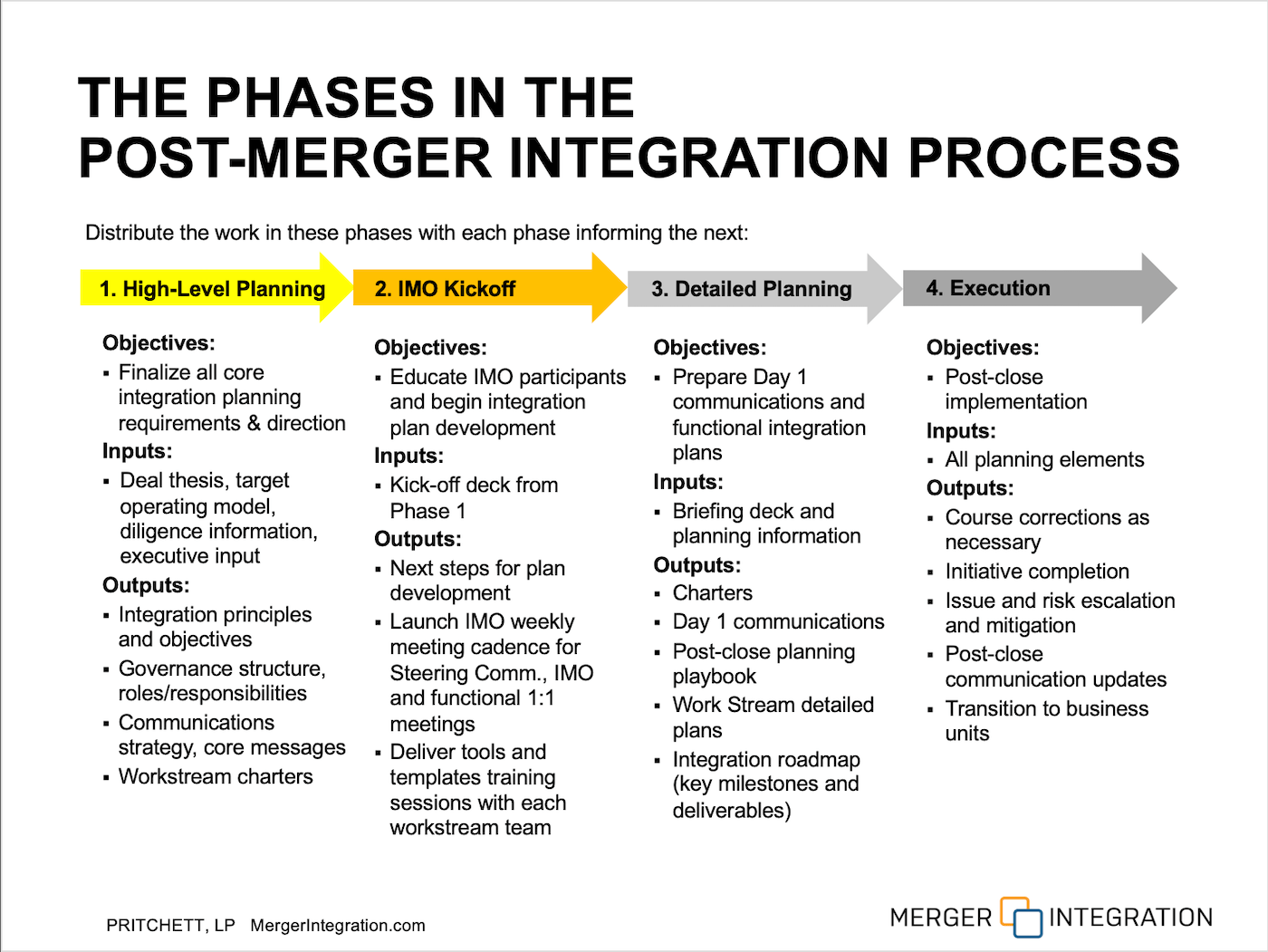

The Phases in the Post-Merger Integration Process

Distribute the work in these phases with each phase informing the next:

1. High-Level Planning

Objectives:

- Finalize all core integration planning requirements & direction

Inputs:

- Deal thesis, target operating model, diligence information, executive input

Outputs:

- Integration principles and objectives

- Governance structure, roles/responsibilities

- Communications strategy, core messages

- Workstream charters

2. IMO Kickoff

Objectives:

- Educate IMO participants and begin integration plan development

Inputs:

- Kick-off deck from Phase 1

Outputs:

- Next steps for plan development

- Launch IMO weekly meeting cadence for Steering Comm., IMO and functional 1:1 meetings

- Deliver tools and templates training sessions with each workstream team

3. Detailed Planning

Objectives:

- Prepare Day 1 communications and functional integration plans

Inputs:

- Briefing deck and planning information

Outputs:

- Charters

- Day 1 communications

- Post-close planning playbook

- Work Stream detailed plans

- Integration roadmap (key milestones and deliverables)

4. Execution

Objectives:

- Post-close implementation

Inputs:

- All planning elements

Outputs:

- Course corrections as necessary

- Initiative completion

- Issue and risk escalation and mitigation

- Post-close communication updates

- Transition to business units

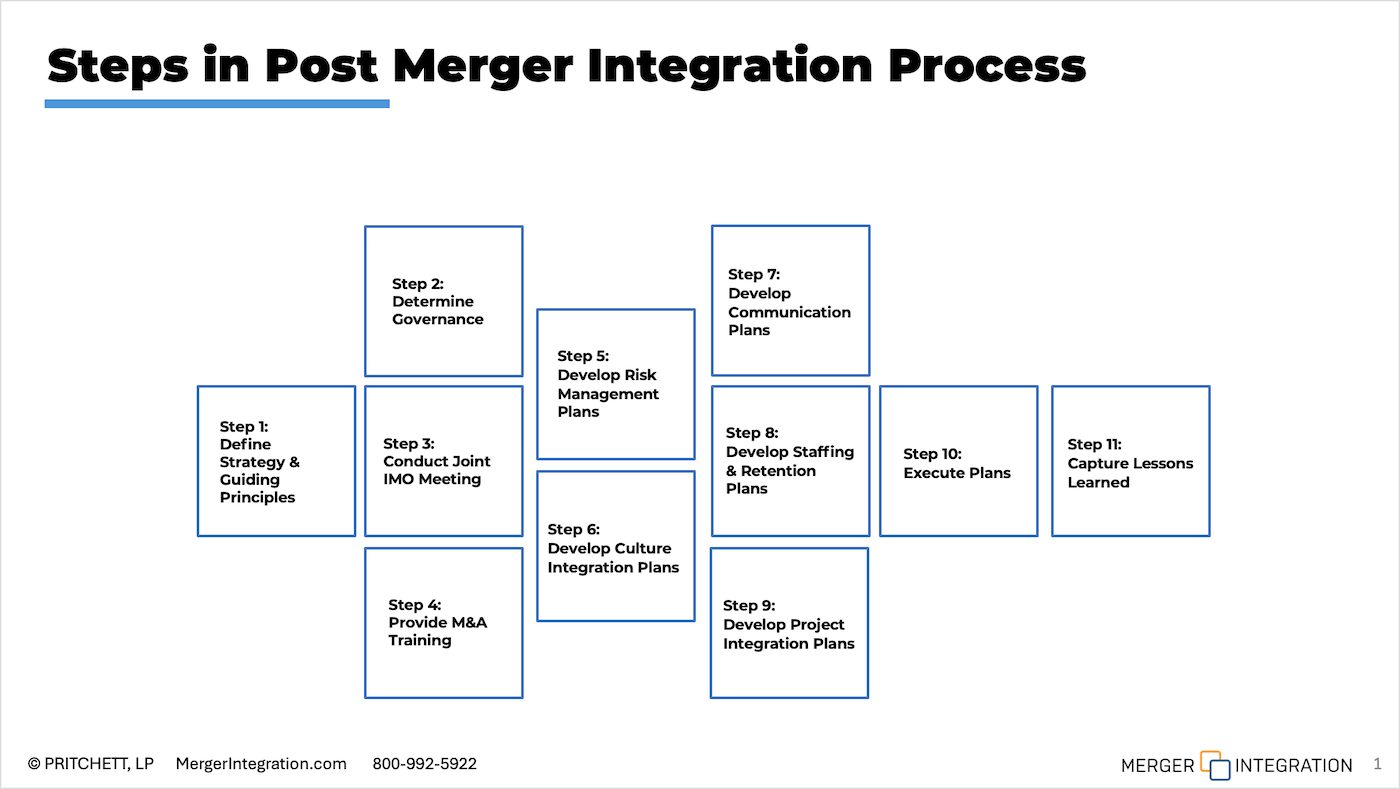

The Steps in the Post-Merger Integration Process

- Define Integration Strategy and Guiding Principles

Facilitate executive session with senior leaders to determine planning direction and clarify integration goals, the extent of the integration, assumptions, non-negotiables, success metrics, and vision. - Determine M&A Integration Governance

Define the hierarchy, structure, roles, and resources for the integration project. - Conduct Integration Management Office (IMO) Meeting

Plan and facilitate an IMO kickoff event to formally commence the integration process and officially onboard integration teams by reviewing pre-planning input, rules of engagement, objectives, and methodology. - Provide Post Merger Integration Training

Teach integration teams a common methodology for the integration. Level set everyone with the same information. - Develop Post Merger Integration Risk Management Plan

Create risk management plan that proactively addresses major events that could negatively impact the integration. - Develop Culture Integration Plans

Perform culture analysis that isolates the cultural risk factors that pose the greatest integration challenges and develop plans to address them. - Develop Post Merger Integration Communication Plans

Create detailed communication plans including detailed Day 1, week 1 schedule, and event sequence. - Develop Post Merger Staffing & Retention Plans

Develop approach, process, and timing for “Newco” cost and organization structure recommendations. - Develop M&A Project Integration Plans

Create a comprehensive project plan and timeline for all integration activities including a detailed integration road map that includes integrated schedule, budget, and milestones for each functional work stream. - Execute Acquisition Integration Plans (Includes Day 1 Plans)

Implement plans and closely monitor the success of implementation with respect to quality, time, costs, and synergies. - Capture M&A Integration Lessons Learned

Debrief to document and capture key learnings about the integration process.

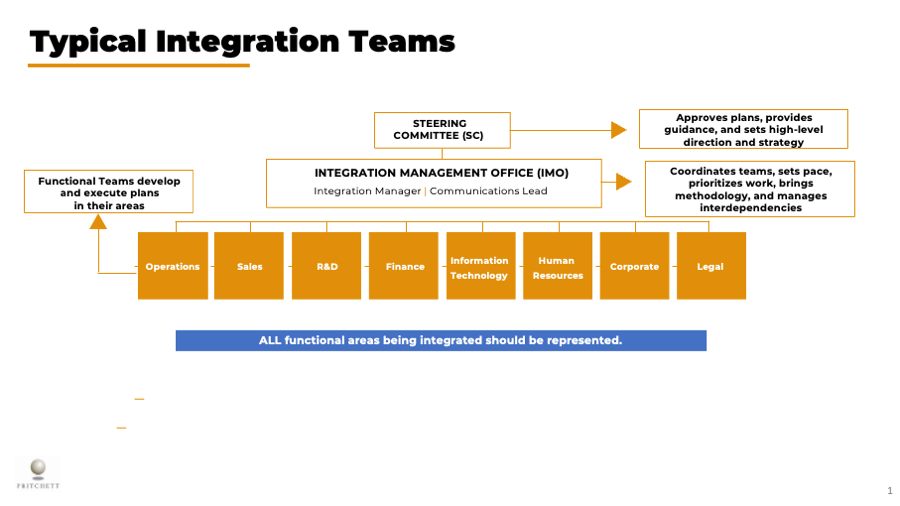

The Typical Post-Merger Integration Teams

A common hierarchy of teams for post-merger integrations is 3 tiered:

- A Steering Committee (at the top of the hierarchy) sets the high-level strategy of the integration

- An Integration Management Office (in the middle) coordinates and tracks work across the teams and

- Functional Teams (at the bottom) plan and execute plans in their areas to achieve the integration strategy

The Responsibilities of the Integration Management Office

- Drives development of the overall integration plan including all the integration projects, communication plans, and achievement of synergy benefits

- Coordinates teams, sets pace, prioritizes work, brings methodology, and manages interdependencies

- Manages stakeholder communication including lists of company executives, functional resource owners, and acquired company managers

- Drives the pace of integration and tackles “ad hoc” issues Tracks continuous improvements such as measuring and surveying various areas, incorporating feedback into updated integration processes and tools, etc.

Establishing an IMO for the purposes of managing integration is highly recommended, as it provides a “home base” for all integration activities. It can be set up as a unique cost center to capture integration-related expenses.

The Responsibilities of the Functional Integration Team Leaders

- Serve as Integration Lead of the respective functional (time commitment will vary by the size and complexity of the integration)

- Develop, track, and report functional work plan progress and issues to the IMO

- Ensure completion and adherence to the scope identified in the Integration Project Charter

- Plan and coordinate overall activities for a specific function

- Participate in integration planning process, and use IMO tools for tracking and communicating information regarding integration activities

- Is point of contact for the IMO as well as its peer functions and the acquired company

- Escalates integration-related issues within their function

- Ensures consistency between intra-function status reporting and integration reporting

- Supports project, synergy, and communication planning and execution

The Functional Integration / Workstream Team Leader is a focal point for accomplishing all functional work, including development of integration work plans, issue management, documentation, and integration closing activities.

The Qualities Of An Effective The Post-Merger Integration Leader

- Subject Matter Expert

- Decisiveness

- A Willingness and Ability to Take Charge

- A Keen Sense of Urgency

- Flexibility and the Ability to Improvise

- Strong Interpersonal Skills

- A Knack for Keeping Many Balls in the Air Simultaneously

- High Tolerance for Stress And Pressure; Psychological Resilience

Ten Post-Merger Integration Best Practices

-

Start Planning Prior to Close

When planning does not start before close, an integration starts more slowly and takes longer. -

Define the Integration Strategy

Executives should communicate a clear integration strategy early and before teams begin detailed planning. -

Maintain the Focus on Priorities

Without effective prioritization, high-payback activities receive too little attention. -

Expedite Organization Design Decisions

Slow decision making on organization design leaves employees in limbo and damages productivity and morale. -

Deliver Frequent and Clear Communications

Communication is usually the worst managed aspect of integrations. -

Implement Synergy Management Program

Synergies should be validated, and then rigorously tracked and reported. -

Dedicate Adequate Resources

Poorly resourced integrations take longer, cost more, delay synergy realization, and often burn people out. -

Engage Strong Project Sponsors

The Steering Committee and Integration Management Office should make sure integration work is not de-prioritized and issues are resolved quickly. -

Establish an End-State Transition Process

The process for handing off integration work (when the end state is near) should be well defined and communicated. -

Document Lessons Learned

Feedback from stakeholder groups should be captured to improve the integration process.

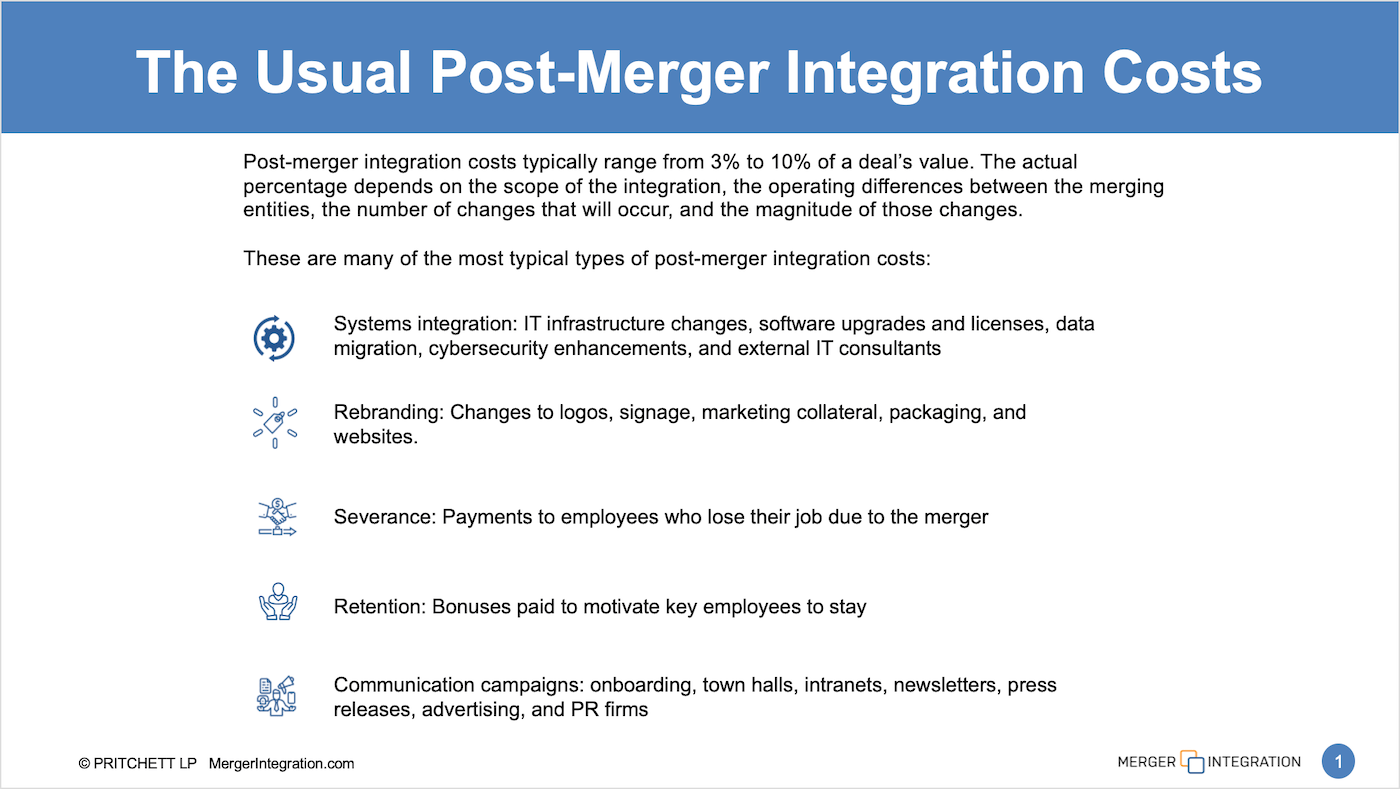

The Usual Post-Merger Integration Costs

Post-merger integration costs typically range from 3% to 10% of a deal’s value. The actual percentage depends on the scope of the integration, the operating differences between the merging entities, the number of changes that will occur, and the magnitude of those changes.

These are many of the most typical types of post-merger integration costs:

- Systems integration: IT infrastructure changes, software upgrades and licenses, data migration, cybersecurity enhancements, and external IT consultants

- Rebranding: Changes to logos, signage, marketing collateral, packaging, and websites.

- Severance: Payments to employees who lose their job due to the merger

- Retention: Bonuses paid to motivate key employees to stay

- Communication campaigns: onboarding, town halls, intranets, newsletters, press releases, advertising, and PR firms

- Training: Technical and soft skill training, and development of new training materials

- Facility consolidation: Equipment and office moves, penalties for terminating leases, and modifying existing facilities

- Customer attrition: Lost revenue from disruptions in service, reduction in quality, or slower responsiveness

- Employee attrition: Recruiting and hiring qualified replacements

- Supply chain integration: Renegotiation of contracts with suppliers, penalties for breaking existing agreements, and logistic changes

- Integration teams: Salaries for integration teams and expenses for outside consultants

- Process and policy harmonization: The time spent implementing new standardized processes and aligning policies

- Compliance programs: Changes to meet legal and regulatory requirements, additional compliance staff, and filing fees

- Legal restructuring: Creation of new legal entities, transfer of assets, and contract updates

- Cultural integration: Communication and team building initiatives, employee surveys, and leadership coaching

- Lost productivity: Employees worried by uncertainty and thereby less focused on business matters

- Delayed projects: Lost market opportunities and/or competitive advantage

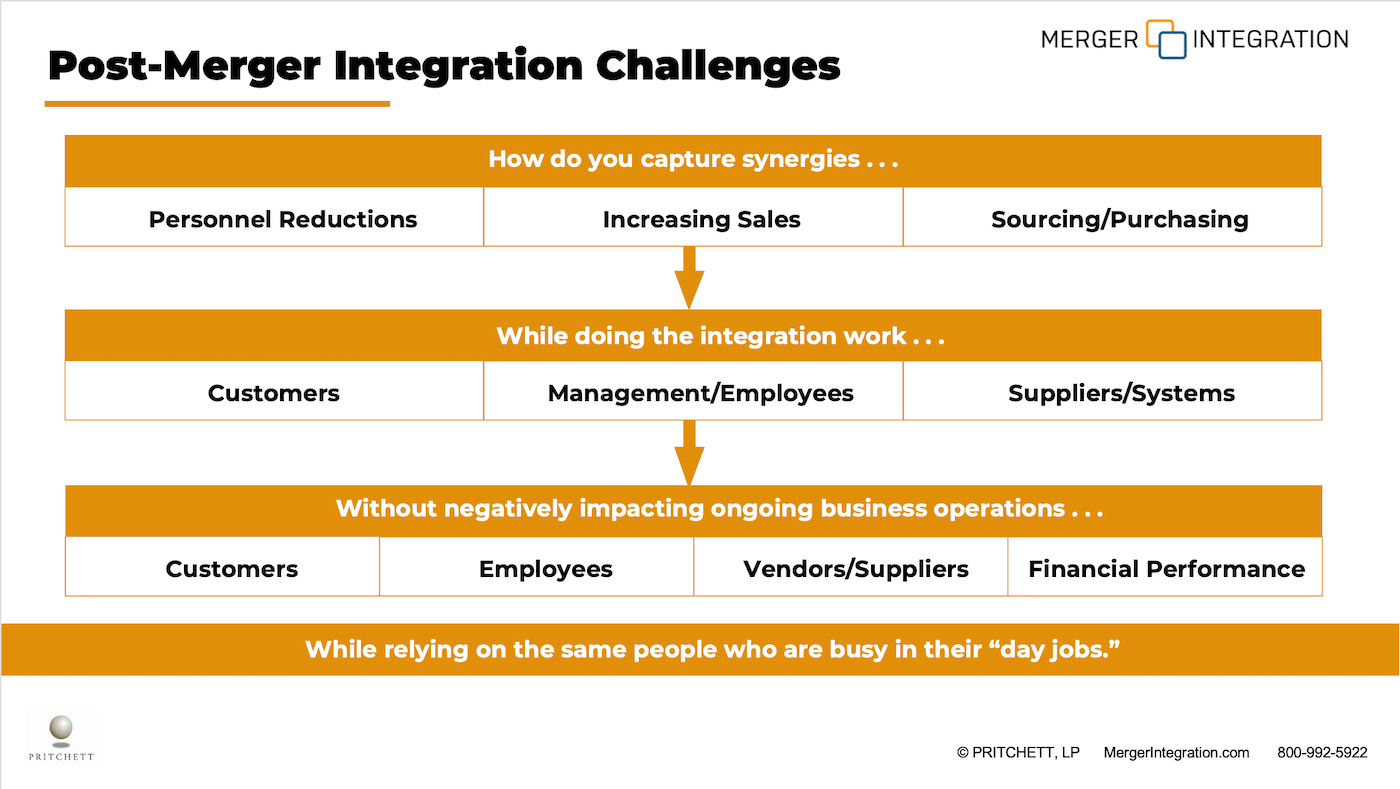

Post Merger Integration Challenges And How To Address Them

How do you capture synergies . . .

- Personnel Reductions

- Increasing Sales

- Sourcing/Purchasing

While doing the integration work . . .

- Customers

- Management/Employees

- Suppliers/Systems

Without negatively impacting ongoing business operations . . .

- Customers

- Employees

- Vendors/Suppliers

- Financial Performance

While relying on the same people who are busy in their “day jobs.”

Follow a Defined Process to Address Challenges

- Consistent Results: Apply the same approach from integration to integration and across company functions

- Teaming: Mobilize new teams quicker and more effectively when there is a process to follow

- Resource Planning: Forecast support requirements more accurately when there is a process to follow

- Execution: Implement more successfully because execution is founded in a good process.

Integrations should not be treated as a “one-off” business exercise.

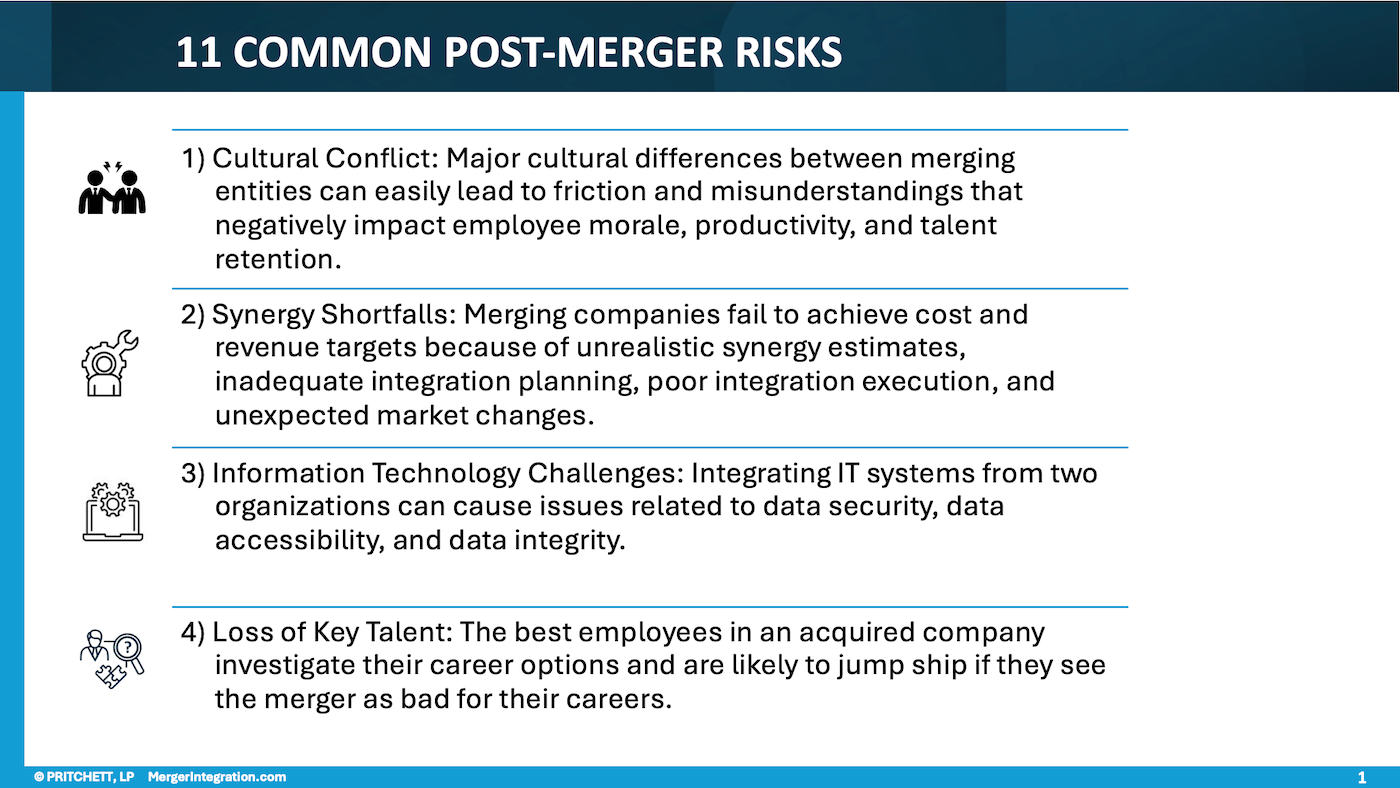

The Most Common Post-Merger Integration Risks

- Cultural Conflict: Major cultural differences between merging entities can easily lead to friction and misunderstandings that negatively impact employee morale, productivity, and talent retention.

- Synergy Shortfalls: Merging companies fail to achieve cost and revenue targets because of unrealistic synergy estimates, inadequate integration planning, poor integration execution, and unexpected market changes.

- Information Technology Challenges: Integrating IT systems from two organizations can cause issues related to data security, data accessibility, and data integrity.

- Loss of Key Talent: The best employees in an acquired company investigate their career options and are likely to jump ship if they see the merger as bad for their careers.

- Execution Problems: Integrating systems, processes, people, and operations is a complex exercise, and if managed badly, leads to increased costs, a slow integration, and customer and employee dissatisfaction.

- Customer Attrition: Changes in products, declines in quality or responsiveness, or service disruptions can drive customers to take their business elsewhere.

- Inadequate Governance: When companies fail to define roles clearly and establish the right decision-making processes, confusion ensues and less is accomplished.

- Regulatory Issues: Failure to meet legal requirements, which are greater in number and more complex on large or cross-border deals, can result in fines, penalties, and reputational damage.

- Decline in Financial Performance: The changes and uncertainty brought about by a merger can distract employees, which in turn, can reduce their productivity and adversely impact revenues and profits.

- Damage to Brand Image: Mergers can dilute brand equity and confuse customers especially if communications to the market are unclear and inconsistent.

- Unnecessary Scope Creep: The addition of non-integration projects to an integration's scope can overtax integration teams, dilute their focus, lengthen the integration, and threaten a deal's success.

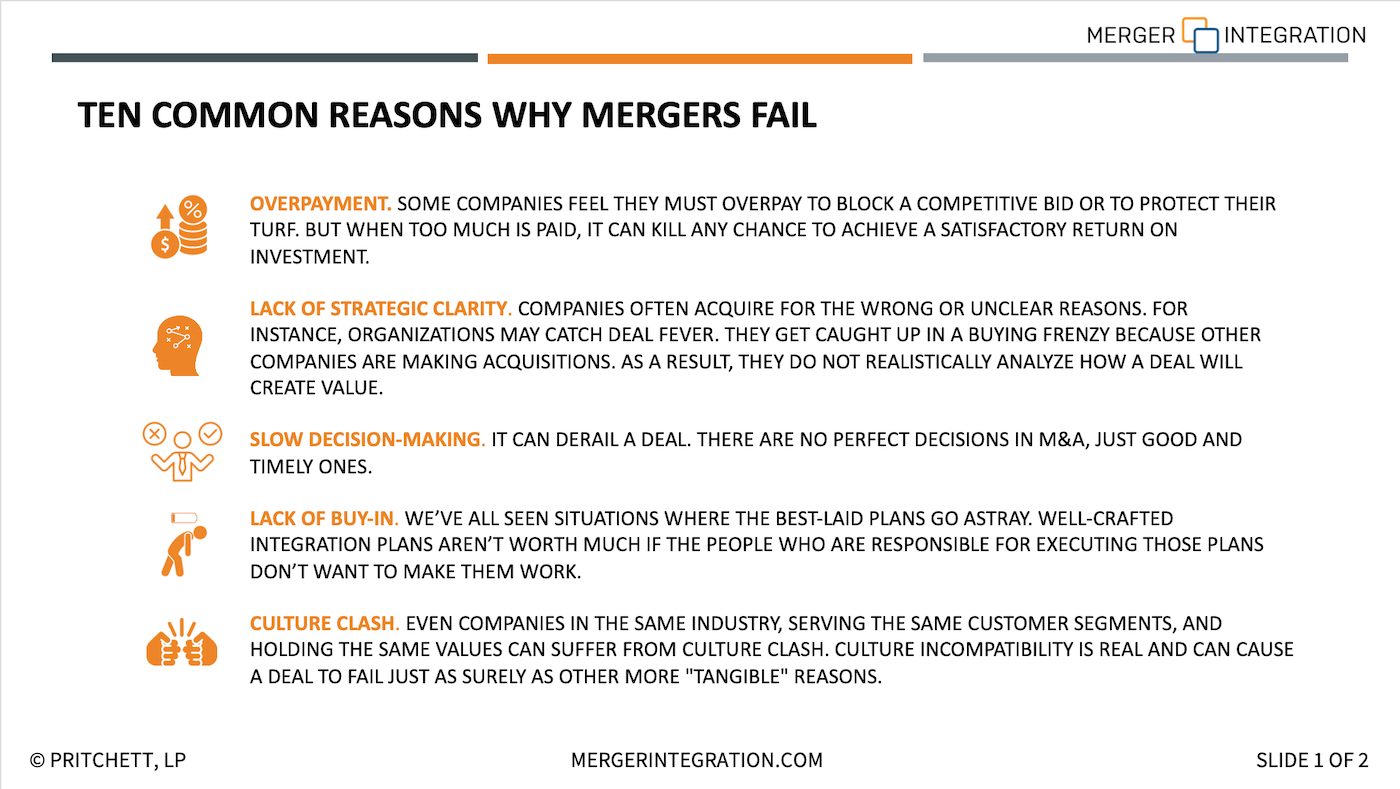

The Reasons Mergers Fail

Overpayment. Some companies feel they must overpay to block a competitive bid or to protect their turf. But when too much is paid, it can kill any chance to achieve a satisfactory return on investment.

Lack of strategic clarity. Companies often acquire for the wrong or unclear reasons. For instance, organizations may catch deal fever. They get caught up in a buying frenzy because other companies are making acquisitions. As a result, they do not realistically analyze how a deal will create value.

Slow decision-making. It can derail a deal. There are no perfect decisions in M&A, just good and timely ones.

Lack of buy-in. We’ve all seen situations where the best-laid plans go astray. WELL-CRAFTED Integration plans aren’t worth MUCH if the people who are responsible for executing those plans don’t want to make them work.

Culture clash. Even companies in the same industry, serving the same customer segments, and holding the same values can suffer from culture clash. Culture incompatibility is real and can cause a deal to fail just as surely as other more "tangible" reasons.

Loss of key customers. Because mergers make the market nervous, competitors may be able to persuade even loyal customers to jump ship....

Erosion of business fundamentals. The urgent demands of integration often take precedence over the day-to-day running of the business. As business fundamentals begin to erode, people tend to blame the problems on the merger. This can begin a vicious downward spiral of reduced revenues, sinking profits, and customer defections.

Talent attrition. M&A often gives key talent inside an organization reason to pause and reconsider their career options. People who might otherwise ignore headhunters may now take their calls.

Under-resourced integrations. Often, the same people responsible for running the business are also tasked with planning and executing the integration. This double workload can burn people out and slow the integration. As a result, some anticipated synergies may be realized late or not at all.

Complexity. Some companies overcomplicate their combinations. They tackle too many problems simultaneously. They fail to prioritize. This can lead to a sense of chaos and confusion that frightens people and leaves them unsure of what to do next.

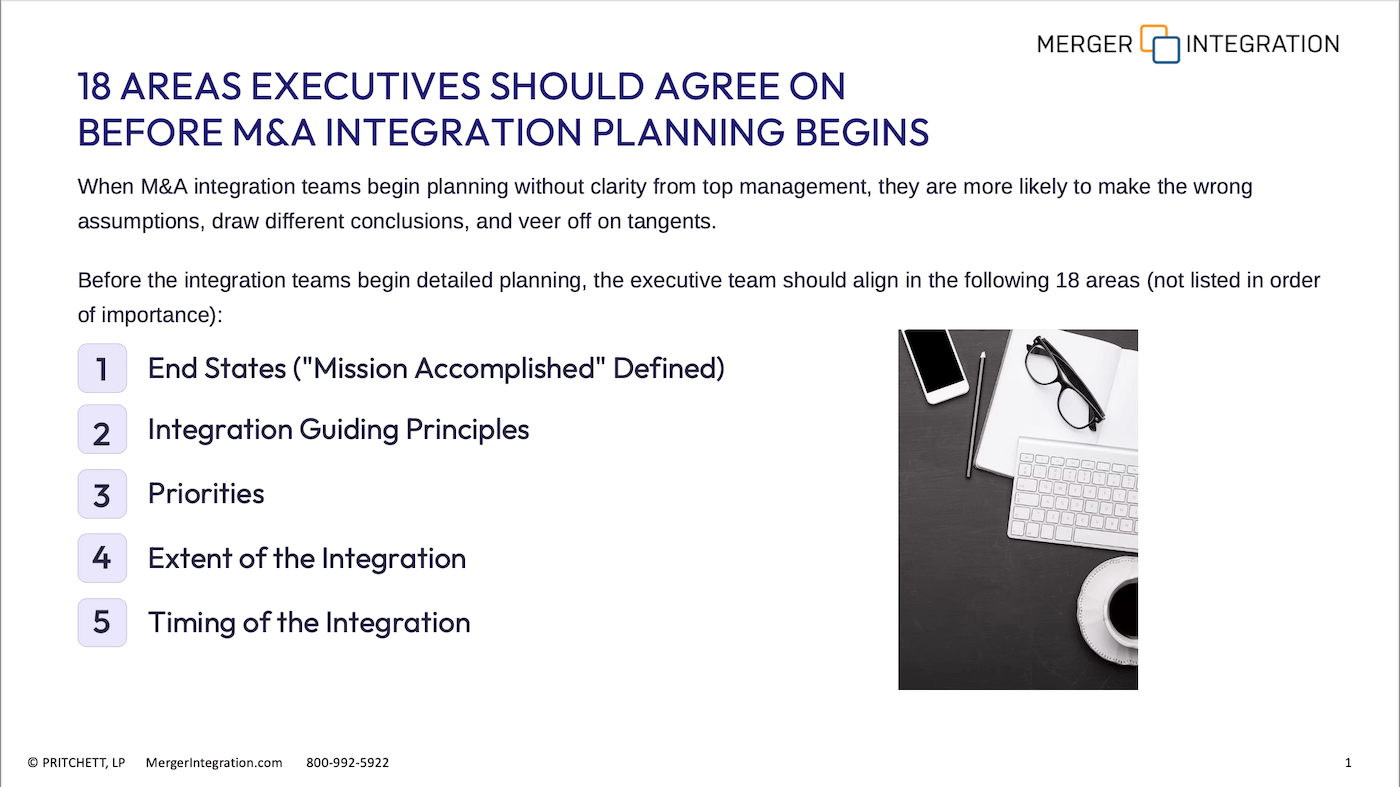

The 18 Areas Executives Should Agree on Before Integration Planning Begins

When M&A integration teams begin planning without clarity from top management, they are more likely to make the wrong assumptions, draw different conclusions, and veer off on tangents.

Before the integration teams begin detailed planning, the executive team should align in the following 18 areas (not listed in order of importance):

- End States ("Mission Accomplished" Defined)

- Integration Guiding Principles

- Priorities

- Extent of the Integration

- Timing of the Integration

- Key Milestones

- Major Risks

- Synergies

- Cost-to-Achieve Synergies

- Additional Benefits from Deal

- Key Objectives

- Integration Metrics

- Product/Service Portfolio

- Go-to-Market Strategy

- Brand Strategy

- Core Messages

- Non-Negotiables

- Day 1 Mandatories

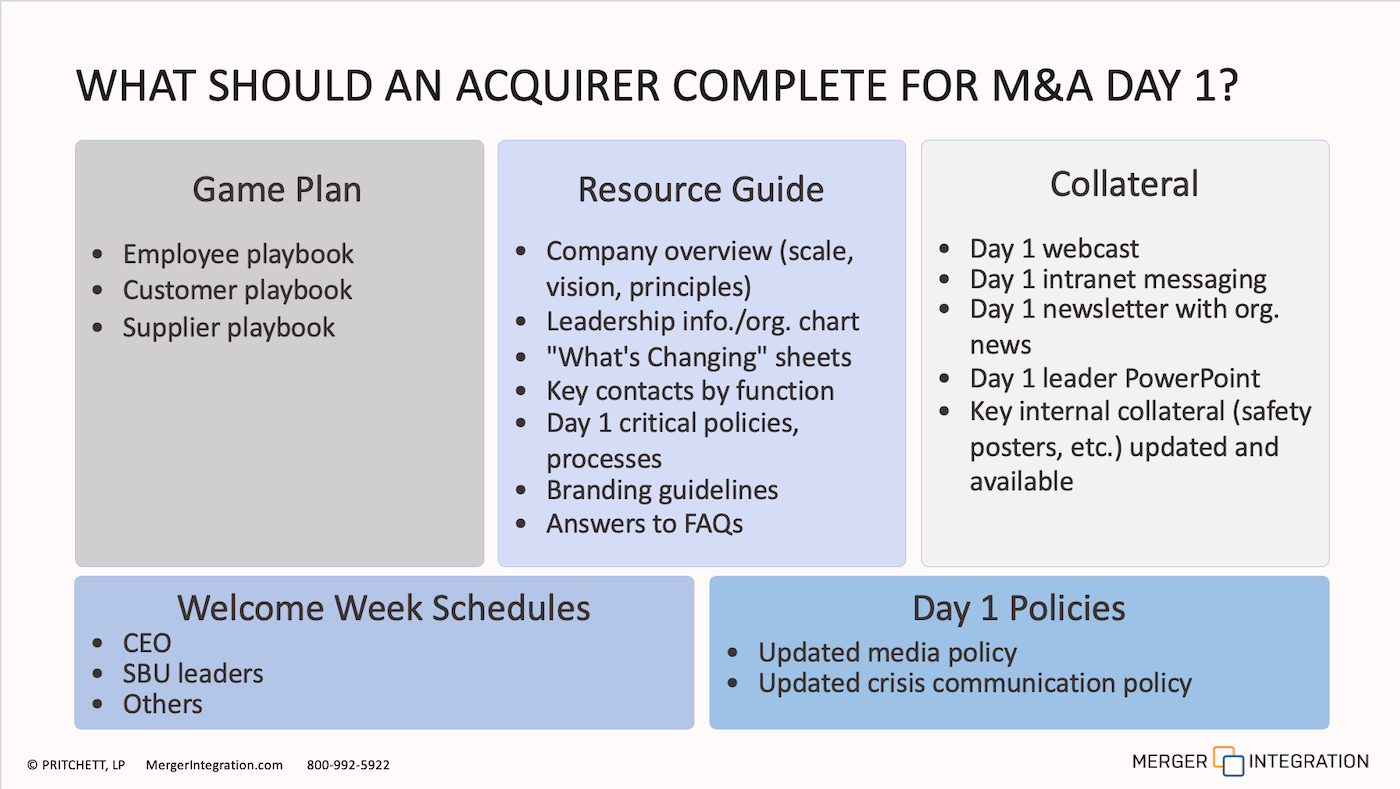

What Should Be Prepared for M&A Day 1?

Game Plan

- Employee playbook

- Customer playbook

- Supplier playbook

Resource Guide

- Company overview (scale, vision, principles)

- Leadership info./org. chart

- "What's Changing" sheets

- Key contacts by function

- Day 1 critical policies, processes

- Branding guidelines

- Answers to FAQs

Collateral

- Day 1 webcast

- Day 1 intranet messaging

- Day 1 newsletter with org. news

- Day 1 leader PowerPoint

- Key internal collateral (safety posters, etc.) updated and available

Welcome Week Schedules

- CEO

- SBU leaders

- Others

Day 1 Policies

- Updated media policy

- Updated crisis communication policy

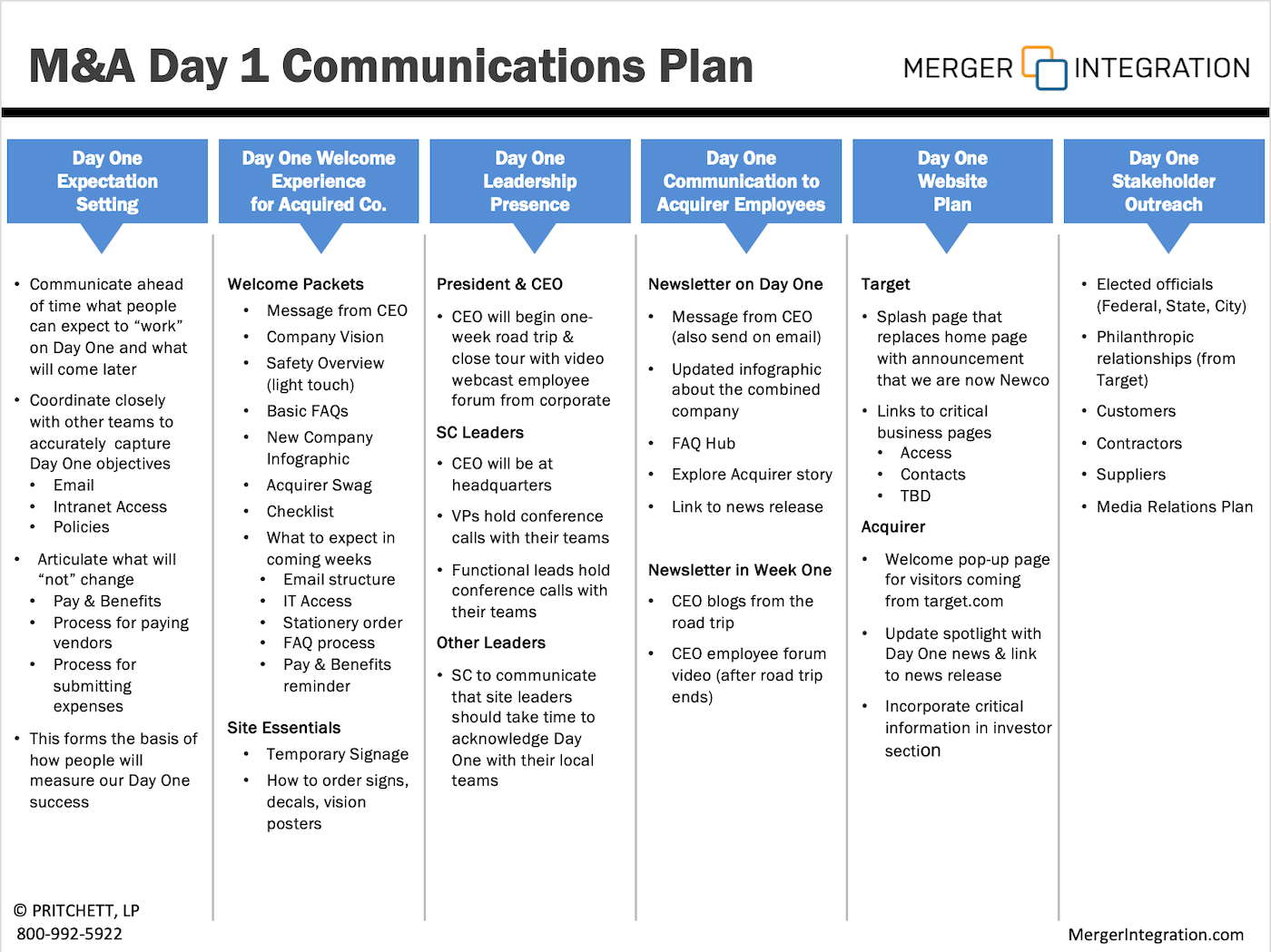

Example of M&A Day 1 Communications Plan

Day One Expectation Setting

- Communicate ahead of time what people can expect to “work” on Day One and what will come later

-

Coordinate closely with other teams to accurately capture Day One objectives

- Intranet Access

- Policies

-

Articulate what will “not” change

- Pay & Benefits

- Process for paying vendors

- Process for submitting expenses

- This forms the basis of how people will measure our Day One success

Day One Welcome Experience for Acquired Co.

Welcome Packets

- Message from CEO

- Company Vision

- Safety Overview (light touch)

- Basic FAQs

- New Company Infographic

- Acquirer Swag

- Checklist

-

What to expect in coming weeks

- Email structure

- IT Access

- Stationery order

- FAQ process

- Pay & Benefits reminder

Site Essentials

- Temporary Signage

- How to order signs, decals, vision posters

Day One Leadership Presence

President & CEO

- CEO will begin one-week road trip & close tour with video webcast employee forum from corporate

SC Leaders

- CEO will be at headquarters

- VPs hold conference calls with their teams

- Functional leads hold conference calls with their teams

Other Leaders

- SC to communicate that site leaders should take time to acknowledge Day One with their local teams

Day One Communication to Acquirer Employees

Newsletter on Day One

- Message from CEO (also send on email)

- Updated infographic about the combined company

- FAQ Hub

- Explore Acquirer story

- Link to news release

Newsletter in Week One

- CEO blogs from the road trip

- CEO employee forum video (after road trip ends)

Day One Website Plan

Target

- Splash page that replaces home page with announcement that we are now Newco

-

Links to critical business pages

- Access

- Contacts

- TBD

Acquirer

- Welcome pop-up page for visitors coming from target.com

- Update spotlight with Day One news & link to news release

- Incorporate critical information in investor section

Day One Stakeholder Outreach

- Elected officials (Federal, State, City)

- Philanthropic relationships (from Target)

- Customers

- Contractors

- Suppliers

- Media Relations Plan

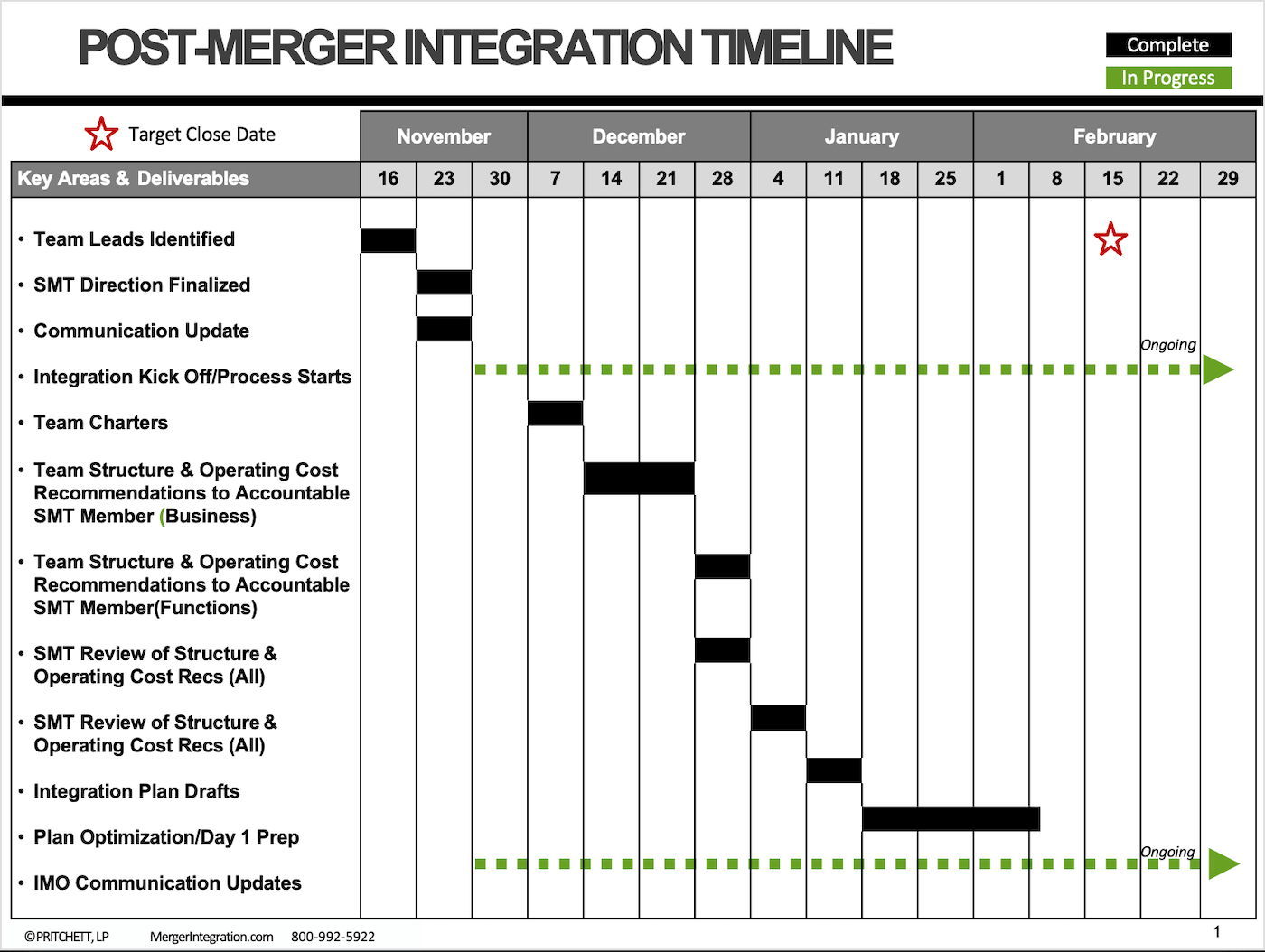

Example of M&A Integration Timeline

Key Areas & Deliverables

- Team Leads Identified

- SMT Direction Finalized

- Communication Update

- Integration Kick Off/Process Starts

- Team Charters

- Team Structure & Operating Cost Recommendations to Accountable SMT Member (Business)

- Team Structure & Operating Cost Recommendations to Accountable SMT Member(Functions)

- SMT Review of Structure & Operating Cost Recs (All)

- SMT Review of Structure & Operating Cost Recs (All)

- Integration Plan Drafts

- Plan Optimization/Day 1 Prep

- IMO Communication Updates

- L2 Integration Plan Briefings

- Close February 15th

- Welcome Week Activities

- Org Announcements

- Employee Forum

- Annual Operating Budget Review

- Synergy Tracking Process Recommendation

- Synergy Gap Closure Initial Recommendations

- Synergy Gap Recommendation Approval

- Integration Plan Post Close Optimization Priorities & Recs

- Synergy Status Reporting Begins

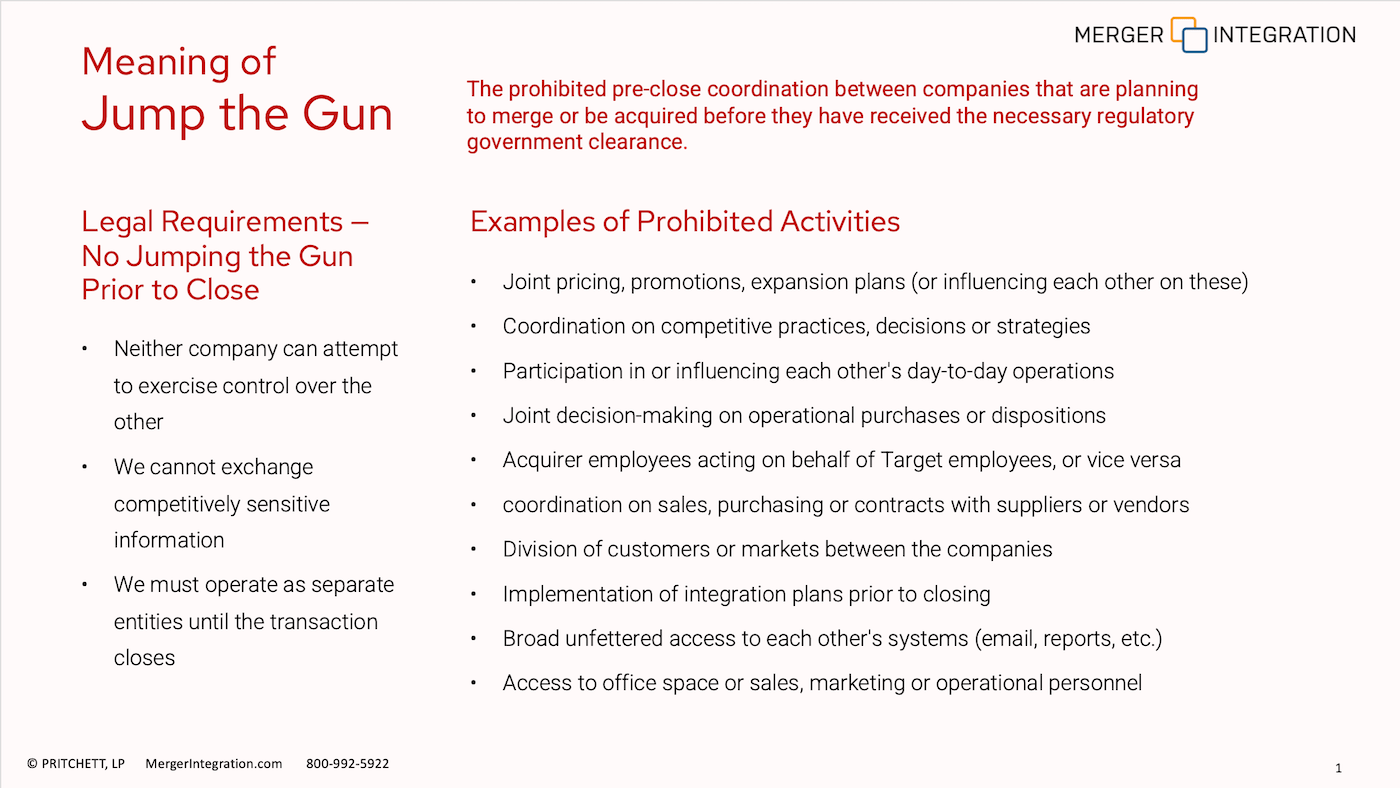

Meaning of Jump the Gun

The prohibited pre-close coordination between companies that are planning to merge or be acquired before they have received the necessary regulatory government clearance.

Legal Requirements — No Jumping the Gun Prior to Close

- Neither company can attempt to exercise control over the other

- We cannot exchange competitively sensitive information

- We must operate as separate entities until the transaction closes

Examples of Prohibited Activities

- Joint pricing, promotions, expansion plans (or influencing each other on these)

- Coordination on competitive practices, decisions or strategies

- Participation in or influencing each other's day-to-day operations

- Joint decision-making on operational purchases or dispositions

- Acquirer employees acting on behalf of Target employees, or vice versa

- coordination on sales, purchasing or contracts with suppliers or vendors

- Division of customers or markets between the companies

- Implementation of integration plans prior to closing

- Broad unfettered access to each other's systems (email, reports, etc.)

- Access to office space or sales, marketing or operational personnel

Competitively Sensitive Information

Before closing, no one should exchange competitively sensitive information with the other party without prior approval from the Legal Department.Examples of competitively sensitive information include:

- Current or future prices, price schedules, pricing policies, pricing plans or terms of sale

- Product-specific costs, including materials, third-party labor supply costs and national vendor contract terms

- Customer and product-specific prices, profitability, profit margins, discounts or rebates

- Vendor prices, profit margins, discounts or rebates

- Competitive strategies, including:

- Sales, bidding and marketing plans

- Specific harvesting plans

- Growth or expansion plans (including product and geographic markets)

- Other strategic plans

- Attempts to retain specific customers, land suppliers or materials/labor suppliers

Activities Permitted Prior to Closing

-

Joint Planning

Joint planning (but not implementation) of the combined company's post-merger organizational structure -

Employee Assessment

Interviewing employees and assessing their qualifications for positions with the combined company post closing -

Third-Party Meetings

In limited circumstances, holding joint "get to know you" visits with third-party commercial counterparties, but only after consulting with the Legal Department and not for sales purposes -

Non-Competitive Discussions

Discussing financial, tax, IT, environmental, health or safety issues that do not include competitively sensitive information -

Asset Valuation

Discussing valuations of assets -

Compensation and Benefits

Explaining respective compensation plans and employee benefits to each other -

Introductory Visits

Conducting "get to know you" visits of people in similar functions -

Transition Planning

Conducting transition team meetings for post-closing operational planning (coordinated in advance through the integration team in consultation with the Legal Department) -

Regulatory Matters

Discussing regulatory compliance -

Technology Assessment

Assessing technology capabilities and synergies in operational positions, but not integrating operations or positions in advance of closing

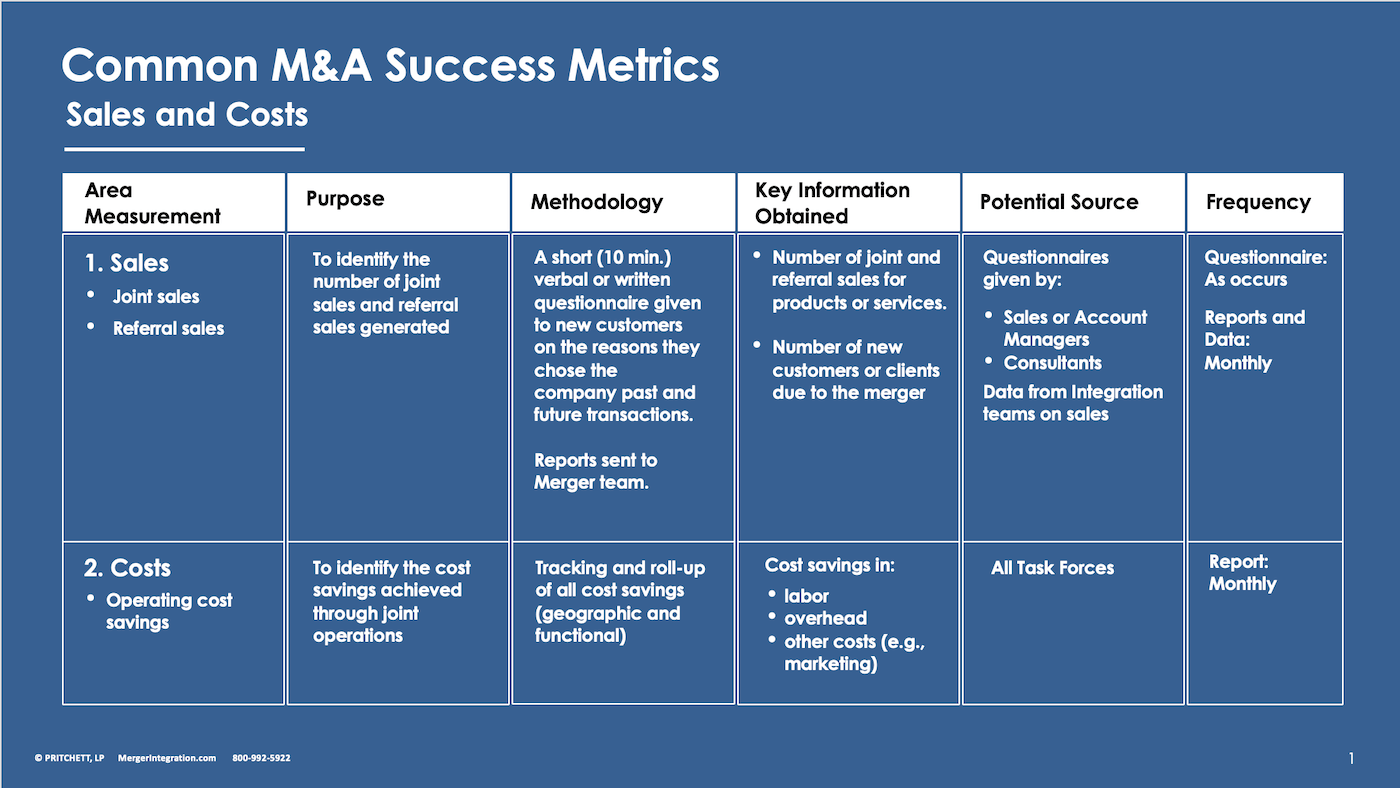

Common M&A Success Metrics

-

Sales

- Area Measurement:

- Joint sales

- Referral sales

- Purpose: To identify the number of joint sales and referral sales generated

- Methodology: A short (10 min.) verbal or written questionnaire given to new customers on the reasons they chose the company past and future transactions. Reports sent to Merger team.

- Key Information Obtained:

- Number of joint and referral sales for products or services.

- Number of new customers or clients due to the merger

- Potential Source:

Questionnaires given by:- Sales or Account Managers

- Consultants

- Frequency:

- Questionnaire: As occurs

- Reports and Data: Monthly

- Area Measurement:

-

Costs

- Area Measurement:

- Operating cost savings

- Purpose: To identify the cost savings achieved through joint operations

- Methodology: Tracking and roll-up of all cost savings (geographic and functional)

- Key Information Obtained:

Cost savings in:- labor

- overhead

- other costs (e.g., marketing)

- Potential Source: All Task Forces

- Frequency:

- Report: Monthly

- Area Measurement:

-

Retention

- Area Measurement:

- Employee attrition rate

- Purpose:

To identify attrition:- Volume

- Rate

- Reason(s)

- Methodology: Short (10 min.) verbal key employee entry and exit survey on reason for choosing or leaving company. Results sent to Merger Team.

- Key Information Obtained:

Attrition rate (exit and entry):- for key employees

- location / division

- reasons / drivers

- Potential Source:

Verbal surveys given by:- Personnel department

- Local managers

- Frequency:

- Survey: As occurs

- Report: Monthly

- Area Measurement:

-

External Company Image

- Area Measurement:

- Customer feedback

- Purpose: To measure a random sample of top 40 customers’ satisfaction and view of the merger

- Methodology:

A short (10 min.) telephone survey of a random sample of top 40 customers (current and past):- interest and awareness of joint product/service offerings

- quality of service

- Key Information Obtained:

- When and why customers leave

- Customer perceptions of new service offerings

- Potential Source:

Survey given by:- Sales or Account Managers

- Employees

- Merger Team members

- Frequency:

- Survey: Monthly

- Report: Monthly

- Area Measurement:

-

Internal Communications

- Area Measurement:

- Quantity

- Quality

- Purpose: To measure adequacy of internal communications about the merger

- Methodology:

A random sample phone survey of key employees on communication:- quantity

- quality

- Key Information Obtained: Verification of receipt of communications by employees

- Potential Source:

Random phone survey given by IMO Team member- electronic tracking of quantity

- Int. team data

- Frequency:

- Survey: Monthly

- Report: Monthly

- Area Measurement:

-

Education and Training

- Area Measurement:

- Quantity

- Quality

- Purpose:

To verify that employees receive proper training in:- New systems and methods

- Both company’s operations, products and services

- Methodology:

A random sample phone survey of key employees on:- recent training

- relevance

- suggestions on future courses

- Key Information Obtained:

- Verification of proper and necessary training to employees

- Areas of training needed identified

- Potential Source:

- Random phone survey given by Merger Team members

- Relevant integration teams identify training needs

- Frequency:

- Survey: Quarterly

- Report: Monthly

- Area Measurement: