“Culture isn’t just one aspect of the game. It is the game.”

—Lou Gerstner, Former IBM Chairman & CEO

HAVE YOU FILED A FLIGHT PLAN for Culture Integration?

Imagine a merger between a couple of bird organizations—one a swarm of blackbirds, the other a wedge of geese. The lead goose and the ranking blackbird come together to announce the deal. “It’s a merger of equals,” they insist to the media. “We’re both in the same type of business and we share many of the same cultural attributes.”

Ballyhooing the promise of the merger, they honk and chirp about how the consolidation will give them competitive advantage in bird land. But then integration begins, and their cultural differences make it impossible for them to fly together.

The geese travel in tight formation, a disciplined v-shaped flock winging dead ahead on the same plane, at the same speed, in the same direction. Meanwhile, the blackbirds swoop, reverse direction, dive, and scatter. Some regroup instantly and veer hard left in a new swarm, while others land or fly off in random pursuits.

The attempt to integrate the two species produces aerial chaos.

“What birdbrains!” you say. “Their deal was doomed from the start.”

But smart executives make the same mistakes. Too often dealmakers focus on a few cultural similarities as proof of compatibility, failing to identify and then reconcile crucial differences that will wreck their chances for merger success.

The fact is culture clash changes the economics of mergers and acquisitions. Incompatibilities carry a huge cost. And—right or wrong—when people talk about M&A efforts that go bad, more than anything else they blame culture.

PRITCHETT has spent over 30 years advising clients on the design and implementation of merger integration strategy. During that time, organizations have grown far more sophisticated and skilled in their ability to execute the integration process.

The one area where companies still struggle, though, is in merging disparate cultures. This is the black box of integration, the most complex problem that executives encounter in M&A.

DOES CORPORATE CULTURE Really Matter in M&A?

The core question driving this research project is whether or not culture deserves serious consideration in the context of mergers and acquisitions. Does it count for much? Is it even a helpful concept? After all, the term “corporate culture” was not even part of the business vocabulary until the mid-1980s.

So as a starting point we asked,

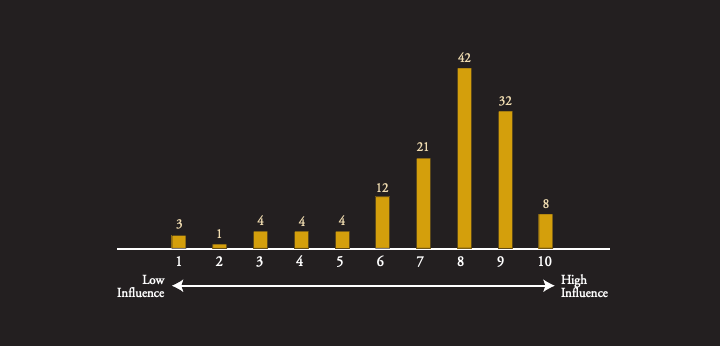

“Based on your experience, how much influence do cultural issues typically have on deal success?”

The table below shows the number of people responding to each point on the 10-point scale.

The prevailing view among the executives we surveyed is that corporate culture plays a significant role in M&A success and failure. The mean score for the total group(two of the 133 participants in the study did not answer this question) is 7.45 on the 10-point scale.

Taken as a whole, Privately Held Companies and Private Equity Firms consistently rate culture as more influential than Public Companies do. Non-Profits rate culture as least influential on deal success.

HOW GOOD ARE ORGANIZATIONS AT Managing Culture in M&A?

It is common practice these days for people to muse about cultural compatibility when companies are being acquired and merged. Some deal makers give it a lot more serious consideration than others do. When mergers go bad, though, the critics, top management, and the business press invariably place much of the blame on culture clash.

Since popular opinion holds that corporate culture plays so heavily in merger success and failure, we wanted the executives in this study to score their organizations’ skills at culture integration.

We asked,

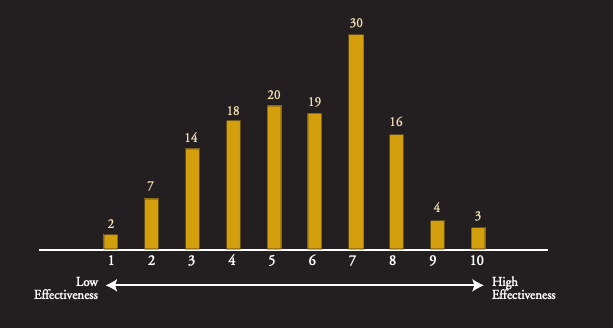

“How would you rate your organization’s effectiveness at handling cultural issues in mergers and acquisitions?”

Above are the ratings our survey respondents gave their companies. The effectiveness scores resemble a bell-shaped curve, implying wide variance in how adroitly organizations are managing the cultural aspects of M&A

The mean effectiveness score for all 133 respondents combined is 5.62.

Comparing the unweighted averages for our four major organization categories, we find Private Equity Firms earning the highest rating, followed in descending order by Privately Held Companies, Non-Profits, then Publicly Held Corporations.

CURRENT PRACTICES in Culture Assessment

Once the idea took hold that culture is important, a handy logic led to the notion that therefore culture should be studied—that it should be measured somehow—to determine the compatibility of merging organizations.

So culture assessment became vogue . . . but precisely what should be measured has remained vague. Furthermore, management often hasn’t known how to constructively use culture assessment data after gathering it.

This study sought answers regarding (1) how widely used and (2) how robust today’s culture assessment techniques are in the M&A arena. We asked our 133 executives,

“Does your company perform any sort of cultural assessment in the process of acquiring/merging other companies?”

Two groups stand out as being the most diligent about assessment: Privately Held Mid Cap Companies and Private Equity Firms. In contrast, the two groups that are least likely to assess culture in the M&A process are Non-Profits and Publicly Held Large Cap Corporations. Specifically, 62% of the Non-Profits forego any kind of culture critique, as do 45% of the Publicly Held Large Caps.

A Look at the Assessment Process

- An early opportunity for sizing up culture occurs in the due diligence process. But surprisingly, only 4% of the executives surveyed report that their organizations include culture-specific questions in their due diligence checklist.

- Similarly, only 5% of the respondents say they conduct a “culture gap analysis” or compatibility study using a structured survey form to determine cultural fit. Those few who do such assessments rely most commonly on in-house staff to do the work.

- Only 2% of the organizations contract with an outside firm to conduct a “culture gap analysis” or compatibility study

- Culture assessment, when it does occur, is typically an unstructured, informal process. Usually this approach consists of senior managers making inferences regarding cultural fit based on their routine interaction with key personnel in the acquisition.

- Very seldom does HR carry primary responsibility for culture assessment. Only 6% of the companies surveyed put HR in charge of this activity.

- Organizations that rate themselves as “highly effective in handling cultural issues in M&A” do culture assessments on 70% of their deals. In contrast, those that score low do assessments only 40% of the time.

CURRENT PRACTICES in Culture Integration

While organizations have a dubious record vis-à-vis culture assessment in M&A, they’re even less invested in the process of actually integrating cultures.

We asked,

“Does your company conduct a formal program specifically designed to facilitate culture integration or culture change when acquiring/merging other firms?”

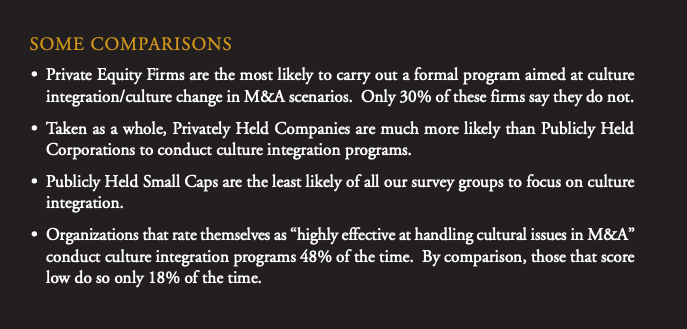

While 39% say they do conduct formal culture integration programs regularly or “sometimes,” it remains unclear just how culture-specific these initiatives truly are.

This study did not delve into the details regarding the mechanics of how organizations go about trying to combine cultures. Some of the executives may perceive their basic merger integration programs to be responsible for facilitating the blending of cultures. Certainly those efforts should help. But this research sought to isolate and identify integration initiatives that were singularly focused on reconciling culture differences.

The results highlight the fact that, far more often than not, companies leave culture integration to chance.

CONCLUSIONS and Implications

So what does all this mean?

The research offers important clues for cracking the code on culture in M&A. Here’s what the data indicate:

- There’s a lot more talk than action on the culture front. Executives pay lip service to the importance of culture in mergers, but they routinely fail to back it up with dollars. Culture is the pauper when integration budgets are allocated.

- Companies that do spend some time and money on cultural matters often proceed without a clear endgame in mind. For example, culture data is gathered with no viable methodology for how it will be used. No surprise—their initiatives fizzle out.

- Most culture assessment efforts are conducted too late to be of much value. They’re also too ad hoc, unstructured, sketchy, and haphazard. In fact, they may very well cause more problems than they solve. There is a clear lack of efficacy in the data-gathering process and how that information is utilized.

- Companies rely on experts in the deal-making process, but then turn culture integration over to people who lack expertise in managing the intense political dynamics and psychological complexities involved.

- Outside consultants have utterly failed at establishing credibility in this arena. Executives have apparently concluded that the purveyors of traditional culture assessment/culture integration services don’t add value.

These findings suggest that the culture challenges inherent in M&A need to be approached from a more promising angle.

- Culture should be a more strategic consideration in the merger process. It deserves far more weight in the initial targeting of potential acquisitions or merger partners.

- Due diligence should scrutinize cultural aspects of the deal with the same discipline given to financial and legal issues. This simply cannot be done via a traditional culture gap analysis or compatibility survey.

- Culture integration should be driven from the CEO/President level. This initiative cannot be delegated effectively. The architecture of culture strategy, plus the critical first steps of execution, belong to the leader.

- Organizations should be more astute in crafting their merger communications relating to cultural issues. Both the substance and timing of these messages are crucial. Management needs to be fine-tuned in managing people’s expectations, all the while shaping workforce behavior in the desired cultural direction.

Let’s note that the executives in this study, taken as a group, give themselves average marks for how they’re managing culture in M&A. But that’s not good enough. If culture heavily influences merger success and failure, there’s simply too much at stake to accept mediocrity. After all, we’re playing with shareholder value here.

A grade of “C” means leaving far too much money on the table.

“Culture is one of the most precious things a company has, so you must work harder on it than anything else.”

—Herb Kelleher, Founder & Chairman Emeritus, Southwest Airlines

About the Study

Culture is a popular topic when people talk about merger issues, but little is known about actual practices. This nationwide research project was designed to explore how acquiring/merging companies currently deal with the challenges of culture integration and culture change.

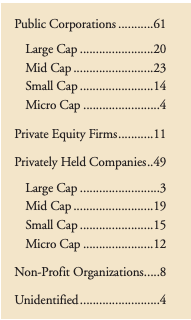

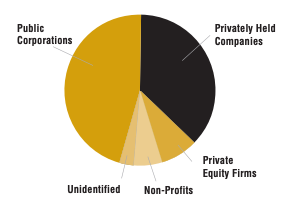

The study gathered data from senior executives in 133 organizations throughout the United States. Our sampling covered a representative cross-section of organizations of diverse types and sizes.

Percentage-wise, the totals in the survey’s four major categories should reasonably approximate the number of mergers and acquisitions occurring annually in the various sectors.

Industries represented in the survey include manufacturing, healthcare, retail, professional services, transportation, energy, financial services and investments, plus many others.

A total of 37 respondents who completed the research questionnaire carry the job title of Chairman, CEO, President, or Managing Partner. Another 71 hold key management positions in the HR function, while the remaining 25 are in a variety of other executive roles.

This broad spectrum of input provides a wideangle look at the current perspectives and practices regarding culture in M&A.