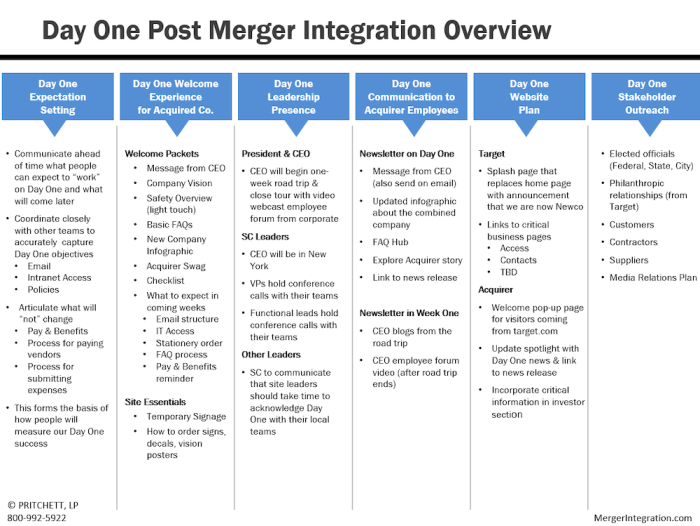

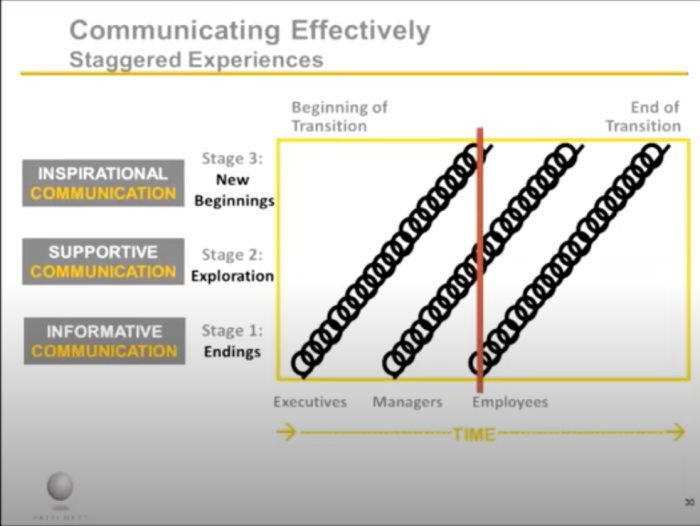

Step 7: Develop M&A Communication Plans

M&A communication planning is difficult because a merger is always a fast-breaking story. Every day brings new developments. The truth is a moving target, and often dead on arrival.

Rumors start to fly as soon as people pick up the scent that a merger is in the works. This is high drama. Hot stuff. Everybody has an opinion, and all the rules of gossip prevail. In this tense environment, it is easy for messages to be misinterpreted, twisted, or exaggerated.

Communication planning requires much more thought in a merger than it does during more stable, less stressful circumstances. Yet, most key managers receive little education on what to say, and just as importantly, what not to say. There is little opportunity for them to make an insignificant remark.