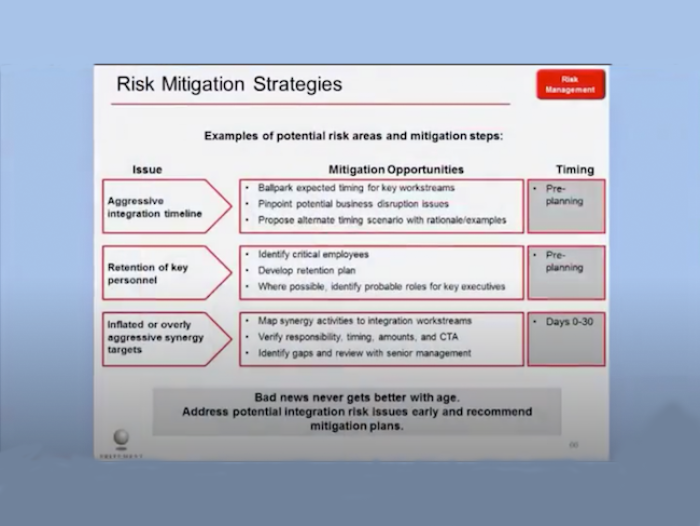

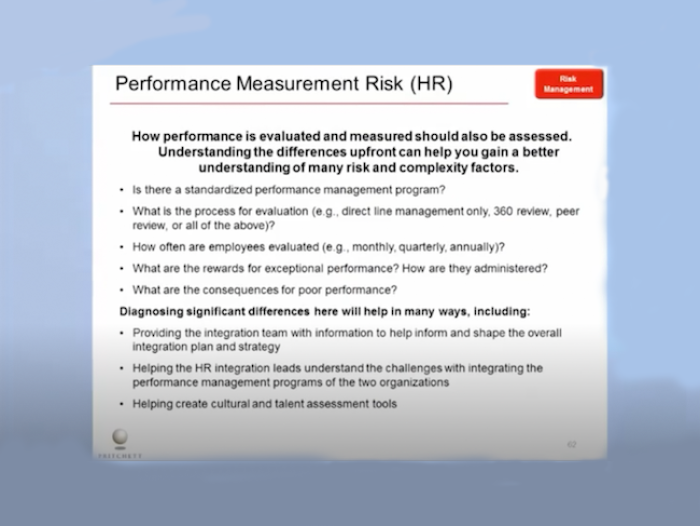

Step 5: Develop Post-Merger Risk Management Plan

Growth through M&A is a high stakes game. The element of risk adds to the drama, excitement, and overall appeal of the merger game. But as always, where there is much to be gained, there is precipitous downside risk as well. Developing a post-merger integration risk management plan is time well-spent.

It is difficult to be over-prepared for an integration. You should plan ahead and anticipate potential problems. In this section, we provide 1) articles, presentations, and videos that reveal M&A integration risks and 2) checklists and tools to help you mitigate and track them.