Answers to Post-Merger FAQS on:

Communication

Day 1

M&A Integration Teams

M&A Integration Plans

Acquisition Integration

Culture

Risks

Managing People

Post-Merger Exam

Based on Answers to FAQs

What are several M&A integration best practices?

Is integrating rapidly a best practice?

Why is following good project management practices necessary during M&A integrations?

Merging is confusing enough even when good project management practices are in place. Without that kind of discipline, the situation can all too easily spin out of control. This is a highly charged political climate where people operate with very different, personalized agendas. There are so many pressure points, conflicting views, and management distractions. Unless you employ a carefully orchestrated project management approach, it is almost impossible to get through the integration without damaging the potential of the deal. Treating the transition period like a special project helps management adhere to the schedule, balance resources, focus on priorities, and manage risk effectively.

What are best practices to follow when integrating small well-run companies?

- Turn off "integration autopilot"

- Don't "wing it"

- Watch the us-to-them ratio

- Concentrate on the most pivotal goals

- Eliminate demands for "didley" data

- Cut people some slack

- Don’t stick founders in ceremonial roles

- Reduce the number of marathon meetings

- Don't jump to conclusions based on job titles

- Be realistic about converting mavericks into company men

What areas deserve extra attention during an M&A integration?

Special attention is needed to protect sales and maintain service standards. The situation calls for new initiatives—high-powered programs that catch people’s attention and produce results. This might include short-term sales incentives or merger training and information for customer service personnel at help desks and call centers. Another possibility might be special advertising aimed at communicating to customers the newly merged organizations’ commitment to service. Whatever the particular prescription, actions to boost sales and service must be deliberately planned and quickly executed.

What should be the priorities during a post-merger integration?

- Shorten the transition period

- Stabilize the organization rapidly

- Strengthen the talent level in the organization

- Reposition the organization to better serve the defined marketplace

- Protect the bottom line

Activities that don’t directly contribute to these objectives are likely to be off target and a poor investment of time and energy.

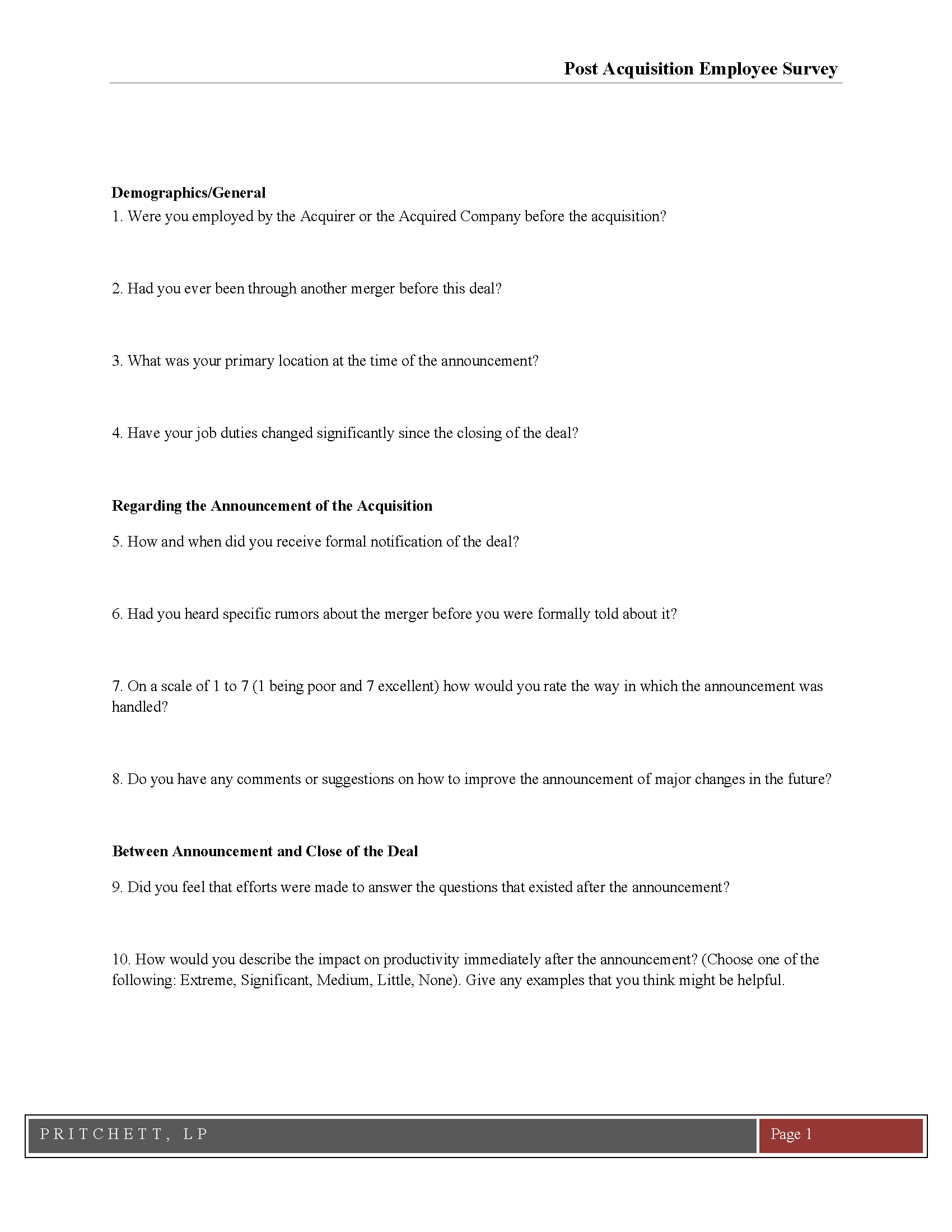

When conducting a post-merger integration audit (which is a best practice), what are several questions that should be asked?

- How were the events, decisions, communications, and actions surrounding the merger handled?

- What could have been done differently to make the integration easier?

- What remains unfinished?

- How have shareholders, customers, and employees perceived the merger?

- If the company were to merge/acquire again, what should be done differently?