Integration Planning FAQs

When should M&A integration planning begin?

Planning should start two to three months before close or when the letter of intent is signed, whichever is earlier. It is difficult to deliver a smooth, effective Day 1 and achieve quick wins in the first 30 days without adequate pre-close planning. Starting the planning process early creates the momentum to integrate after close.

What is the first step in integration planning?

During the initial step, executives agree on the integration's strategy, guiding principles, objectives, assumptions, and non-negotiables. The integration plans will be drafted from the direction set by senior management, so there should be early discussions to identify and resolve divergent opinions.

Why is M&A Day 1 planning so important?

The acquirer's opening moves are critical because first impressions can be lasting impressions. Acquirers need to get out the gate cleanly. How you begin the integration process carries heavy influence over how you will finish.

Why should integration teams plan early wins?

Wins build momentum. Success feeds on success, so it is important for each team to establish an early win streak. This helps build confidence and silence skeptics.

What is the end state of a post-merger integration?

The end state is what the organization plans to look like at the integration’s conclusion. When teams struggle to complete their plans, it is often because their end states have not been determined. They do not know what they are integrating towards; there is no defined finish line.

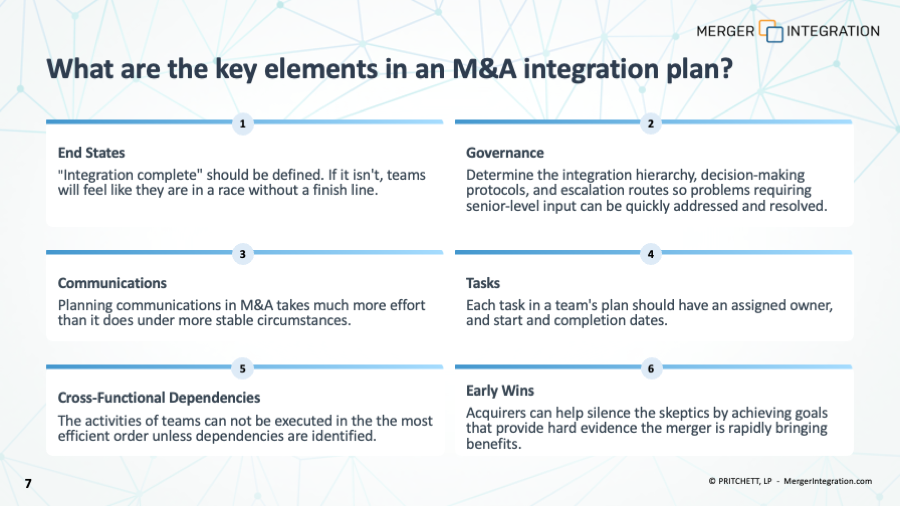

Key Elements in an M&A Integration Plan

6 Critical Components for a Successful Plan

To What Extent Should Acquirers Plan to Integrate?

It depends on the deal rationale.

Full Integration: If an acquisition is being made to achieve economies of scale, then a full integration may be the best approach.

Selective Integration: If the deal is done to expand into new regions or acquire new competencies, then the best way to create value may be to selectively integrate in only areas that overlap.

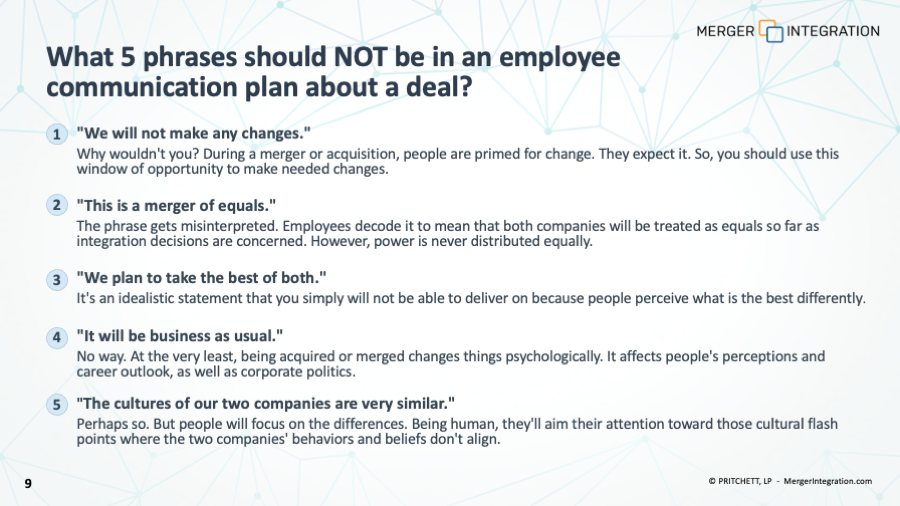

5 Phrases to AVOID in Employee Communications

Communication Pitfalls

- "We will not make any changes." - People are primed for and expect change. Use this window of opportunity to make needed changes.

- "This is a merger of equals." - This gets misinterpreted. Power is never distributed equally, and employees will decode it differently.

- "We plan to take the best of both." - An idealistic statement you can't deliver on because people perceive "the best" differently.

- "It will be business as usual." - It won't be. Mergers change things psychologically, affecting perceptions, career outlooks, and corporate politics.

- "The cultures of our two companies are very similar." - People will inevitably focus on the differences and cultural flashpoints where behaviors and beliefs don't align.