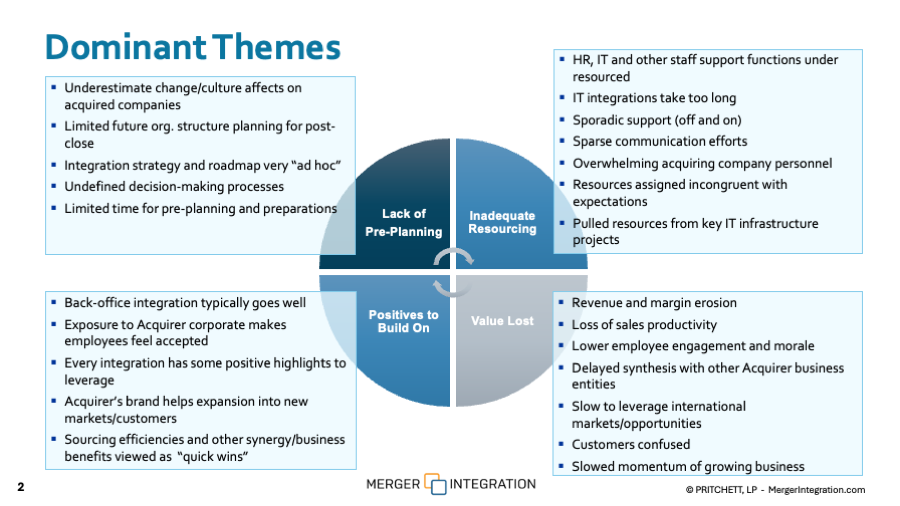

Dominant Themes

Lack of Pre-Planning

- Underestimate change/culture effects on acquired companies

- Limited future org. structure planning for post-close

- Integration strategy and roadmap very "ad hoc"

- Undefined decision-making processes

- Limited time for pre-planning and preparations

Inadequate Resourcing

- HR, IT and other staff support functions under resourced

- IT integrations take too long

- Sporadic support (off and on)

- Sparse communication efforts

- Overwhelming acquiring company personnel

- Resources assigned incongruent with expectations

- Pulled resources from key IT infrastructure projects

Positives to Build On

- Back-office integration typically goes well

- Exposure to Acquirer corporate makes employees feel accepted

- Every integration has some positive highlights to leverage

- Acquirer's brand helps expansion into new markets/customers

- Sourcing efficiencies and other synergy/business benefits viewed as "quick wins"

Value Lost

- Revenue and margin erosion

- Loss of sales productivity

- Lower employee engagement and morale

- Delayed synthesis with other Acquirer business entities

- Slow to leverage international markets/opportunities

- Customers confused

- Slowed momentum of growing business

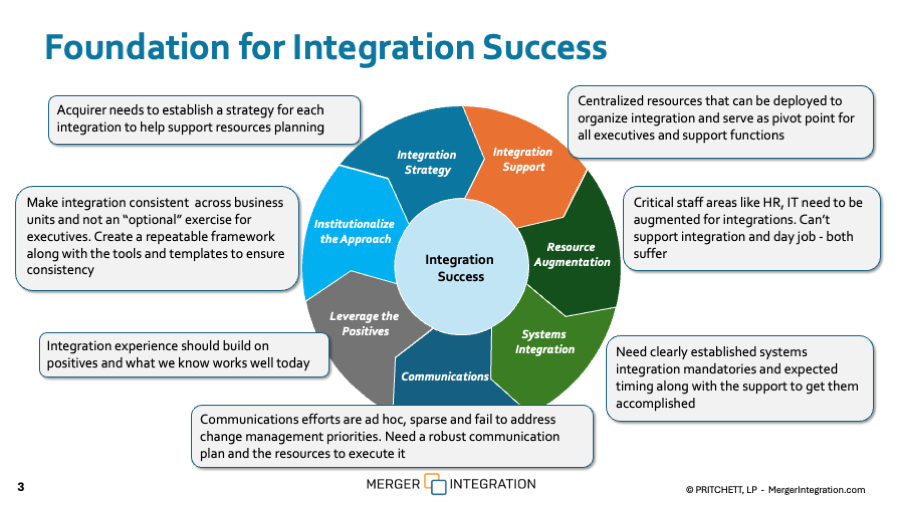

Foundation for Integration Success

Integration Strategy

Acquirer needs to establish a strategy for each integration to help support resources planning.

Integration Support

Centralized resources that can be deployed to organize integration and serve as pivot point for all executives and support functions.

Resource Augmentation

Critical staff areas like HR, IT need to be augmented for integrations. Can't support integration and day job - both suffer.

Systems Integration

Need clearly established systems integration mandatories and expected timing along with the support to get them accomplished.

Communications

Communications efforts are ad hoc, sparse and fail to address change management priorities. Need a robust communication plan and the resources to execute it.

Leverage the Positives

Integration experience should build on positives and what we know works well today.

Institutionalize the Approach

Make integration consistent across business units and not an "optional" exercise for executives. Create a repeatable framework along with the tools and templates to ensure consistency.

Stakeholder Feedback: What We Heard

Pre-Integration Planning

- Setting no organized pre-planning resulted in slow start

- Limited or no intra-functional coordination

- Need an integration plan that aligns with acquired company's capabilities and Acquirer's ambitions

- No cultural assessment to gauge assimilation complexities

- Could not start until 2 weeks after close so we were immediately behind

- Functional planning efforts were pretty siloed - no cross functional coordination

- Need more formalized functional checklists and timing expectations

- Planning is one thing, setting aside resources to execute is another

- Identify integration leads at the acquired company during pre-planning, not midway thru the integration

- Need more robust analysis of engineering, manufacturing processes, and equipment

- Need better mapping of functional dependencies so we can sequence integration efforts

- Need to put more thought into commercial go-to-market plan for combined Acquirer/Acquired Company operating model. Even our existing customers were confused

- What is the ultimate strategy now that we have a few businesses that overlap in some key areas - are we going to synthesize them somehow?

Integration Strategy

- Integration strategy was fuzzy - no real roadmap

- "Wait and see" is not a strategy or a plan

- Our integration strategy is theoretical and not grounded in reality

- We are not learning as we go and getting better - we seem to repeat mistakes

- Auction process does not allow for robust pre-deal due-diligence

- Need to formalize the "new" business strategy before starting integration work

- Key strategies need to be better defined. "Expedited product development" sounds great but what does that really mean?

- Branding decisions incredibly slow to develop - let's stop and figure out the vision before we proceed

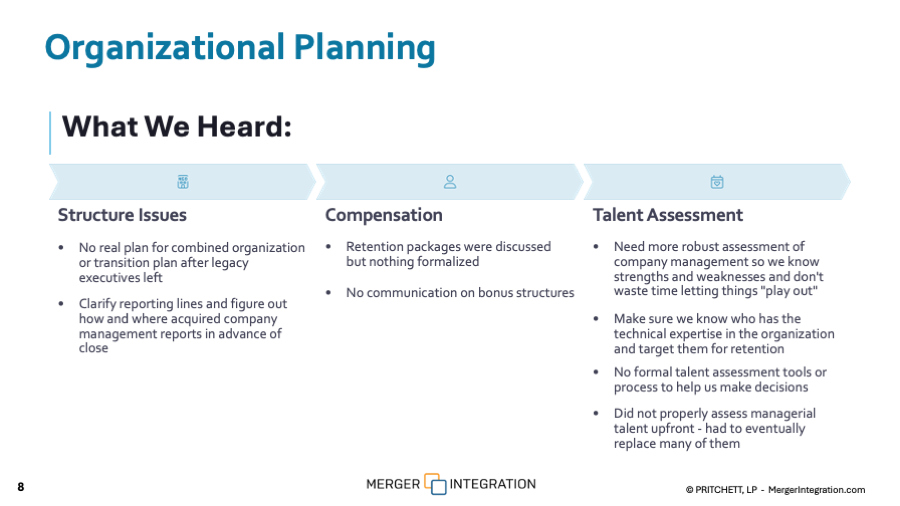

Organizational Planning

Structure Issues

- No real plan for combined organization or transition plan after legacy executives left

- Clarify reporting lines and figure out how and where acquired company management reports in advance of close

Compensation

- Retention packages were discussed but nothing formalized

- No communication on bonus structures

Talent Assessment

- Need more robust assessment of company management so we know strengths and weaknesses and don't waste time letting things "play out"

- Make sure we know who has the technical expertise in the organization and target them for retention

- No formal talent assessment tools or process to help us make decisions

- Did not properly assess managerial talent upfront - had to eventually replace many of them

Integration Success

- We preserve what we bought them for

- Acquired company able to do financial reporting on their own

- We capture best practices from acquired companies that can help Acquirer

- If things are the same, we are not integrating and creating value

- Companies fully embrace and understand (and leverage) all of the advantages Acquirer can offer

- Form a lean tiger team to fully operationalize our lean competencies sooner so acquired companies can benefit from our expertise

- Scope cross-selling opportunities in advance and create an implementation plan to realize them - they won't happen without a plan (compensation changes, training, etc.)

- Establish and communicate the roles of Acquirer's integration leads in advance

- We need tracking and updates on a regular cadence

- Require a common approach, "integration" seems like an optional exercise for some

- Successful transfer of what we do well into acquired company

- Share a high-level integration plan with acquired company senior management in advance to help set expectations and better address resource issues

- Avoid the "soft first year syndrome" by having a robust integration plan

- Create "tiger teams" for critical functions like IT, HR etc. that can deploy to integrations

- Join forces to crack complex problems together vs. working mutually exclusively

- Within the first 30-60 days have an idea of what the branding plan is going to be

- Follow pre-defined phasing so we can plan ahead

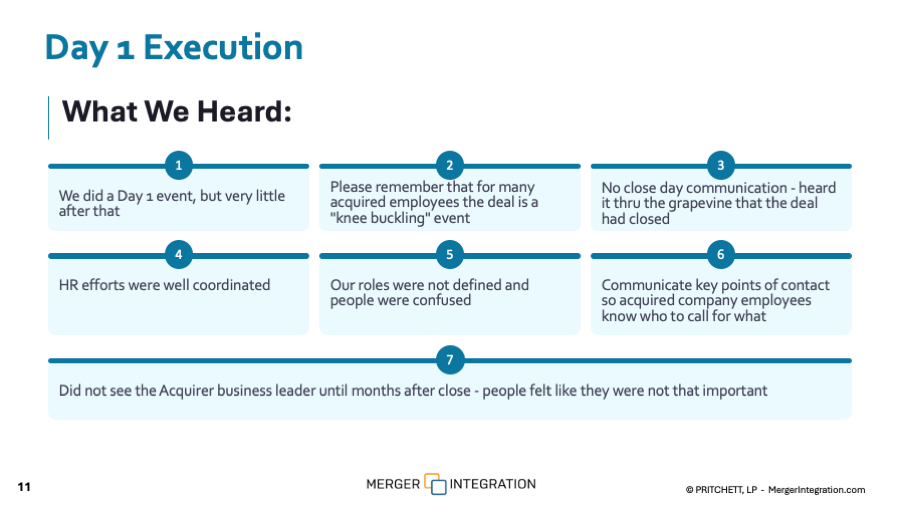

Day 1 Execution

- We did a Day 1 event, but very little after that

- Please remember that for many acquired employees the deal is a "knee buckling" event

- No close day communication - heard it thru the grapevine that the deal had closed

- HR efforts were well coordinated

- Our roles were not defined and people were confused

- Communicate key points of contact so acquired company employees know who to call for what

- Did not see the Acquirer business leader until months after close - people felt like they were not that important

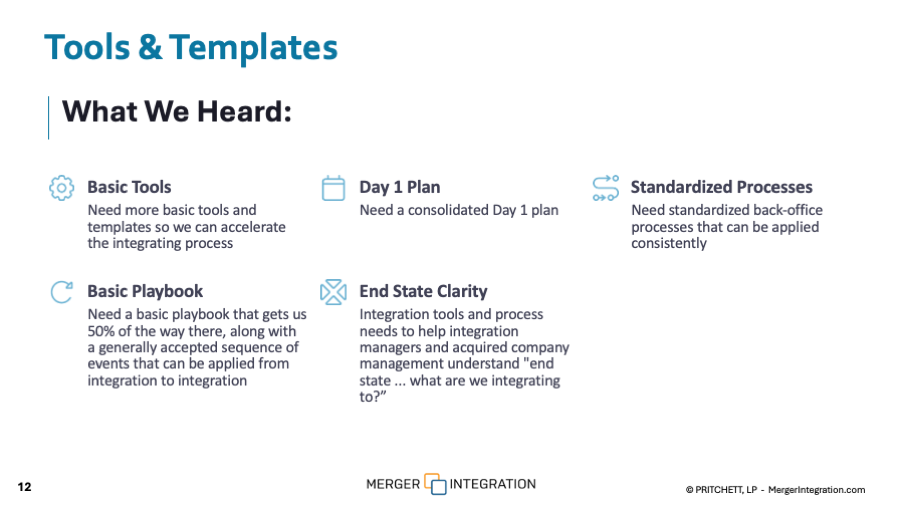

Tools & Templates

Basic Tools

Need more basic tools and templates so we can accelerate the integrating process

Day 1 Plan

Need a consolidated Day 1 plan

Standardized Processes

Need standardized back-office processes that can be applied consistently

Basic Playbook

Need a basic playbook that gets us 50% of the way there, along with a generally accepted sequence of events that can be applied from integration to integration

End State Clarity

Integration tools and process needs to help integration managers and acquired company management understand "end state ... what are we integrating to?"

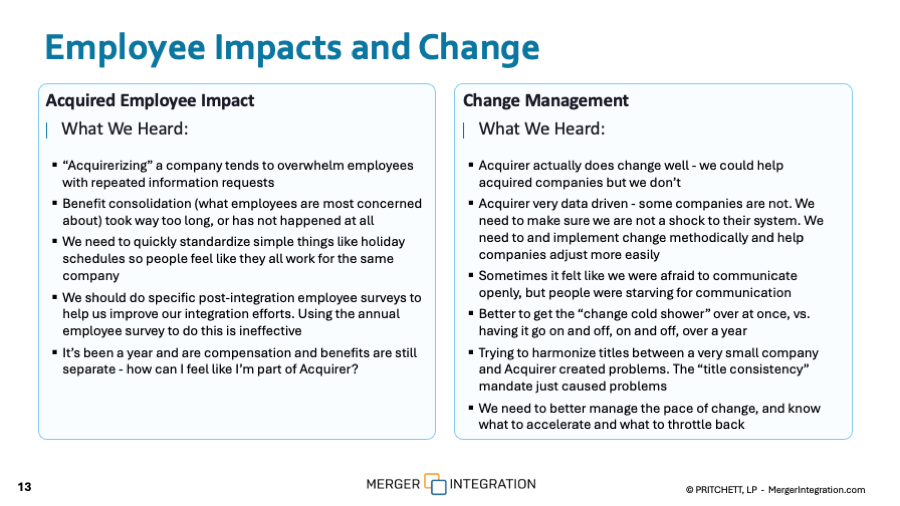

Acquired Employee Impact

- "Acquirerizing" a company tends to overwhelm employees with repeated information requests

- Benefit consolidation (what employees are most concerned about) took way too long, or has not happened at all

- We need to quickly standardize simple things like holiday schedules so people feel like they all work for the same company

- We should do specific post-integration employee surveys to help us improve our integration efforts. Using the annual employee survey to do this is ineffective

- It's been a year and are compensation and benefits are still separate - how can I feel like I'm part of Acquirer?

Change Management

- Acquirer actually does change well - we could help acquired companies but we don't

- Acquirer very data driven - some companies are not. We need to make sure we are not a shock to their system. We need to and implement change methodically and help companies adjust more easily

- Sometimes it felt like we were afraid to communicate openly, but people were starving for communication

- Better to get the "change cold shower" over at once, vs. having it go on and off, on and off, over a year

- Trying to harmonize titles between a very small company and Acquirer created problems. The "title consistency" mandate just caused problems

- We need to better manage the pace of change, and know what to accelerate and what to throttle back

IT/Systems

- Transitioning to common email platform took a year (or still isn't done) - how can we feel like we are part of Acquirer when I can't find people and organize a meeting in Outlook?

- Took over a year to get into new system

- Connection to Acquirer network took 18 months!

- VDR process seemed to be overly cumbersome

- Need some standard SLAs to guide IT efforts and help set expectations for IT resource requirements (e.g., email platform integration within 90 days of close)

- Corporate IT resources already stretched thin - integration actually robs resources from corporate infrastructure projects

- When we acquire a company with a substandard network infrastructure, we need to stabilize it first before we try force more work on top of it for our own reporting needs as it affects their ability to maintain business continuity

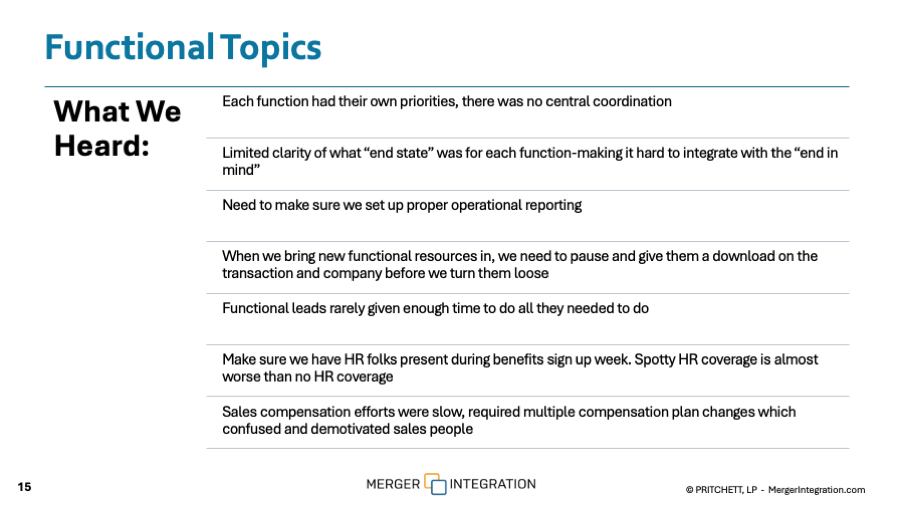

Functional Topics

- Each function had their own priorities, there was no central coordination

- Limited clarity of what "end state" was for each function-making it hard to integrate with the "end in mind"

- Need to make sure we set up proper operational reporting

- When we bring new functional resources in, we need to pause and give them a download on the transaction and company before we turn them loose

- Functional leads rarely given enough time to do all they needed to do

- Make sure we have HR folks present during benefits sign up week. Spotty HR coverage is almost worse than no HR coverage

- Sales compensation efforts were slow, required multiple compensation plan changes which confused and demotivated sales people

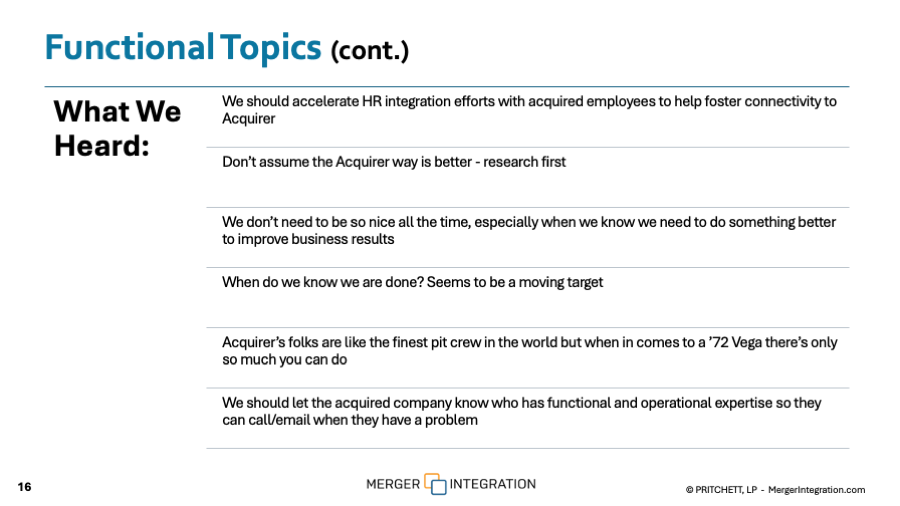

- We should accelerate HR integration efforts with acquired employees to help foster connectivity to Acquirer

- Don't assume the Acquirer way is better - research first

- We don't need to be so nice all the time, especially when we know we need to do something better to improve business results

- When do we know we are done? Seems to be a moving target

- Acquirer's folks are like the finest pit crew in the world but when in comes to a '72 Vega there's only so much you can do

- We should let the acquired company know who has functional and operational expertise so they can call/email when they have a problem

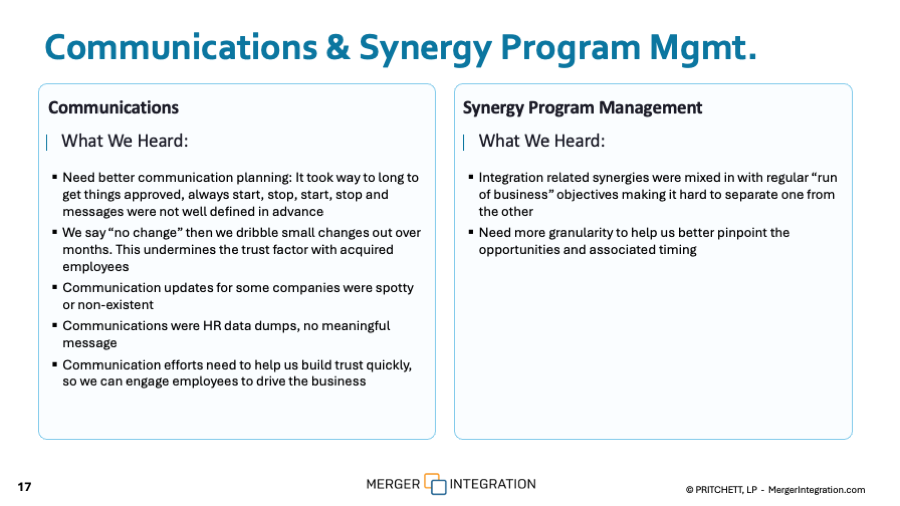

Communications

- Need better communication planning: It took way to long to get things approved, always start, stop, start, stop and messages were not well defined in advance

- We say "no change" then we dribble small changes out over months. This undermines the trust factor with acquired employees

- Communication updates for some companies were spotty or non-existent

- Communications were HR data dumps, no meaningful message

- Communication efforts need to help us build trust quickly, so we can engage employees to drive the business

Synergy Program Management

- Integration related synergies were mixed in with regular "run of business" objectives making it hard to separate one from the other

- Need more granularity to help us better pinpoint the opportunities and associated timing

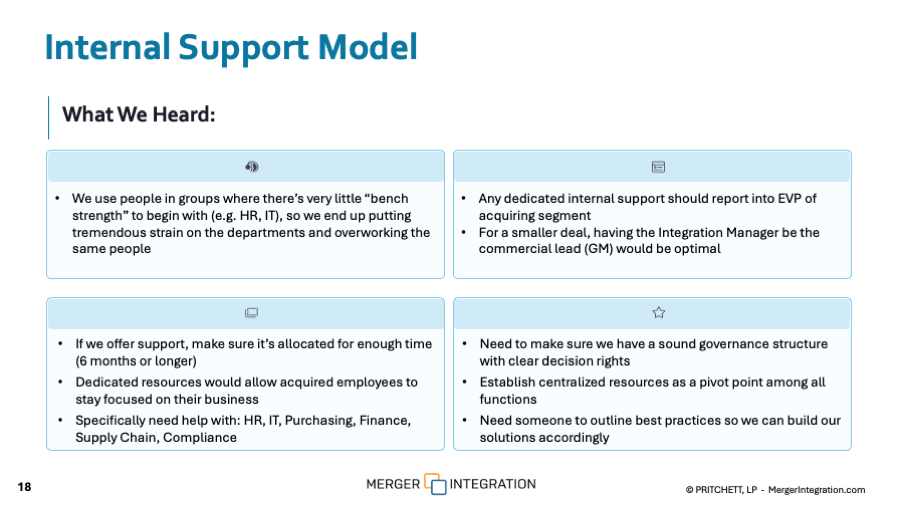

Internal Support Model

- We use people in groups where there's very little "bench strength" to begin with (e.g. HR, IT), so we end up putting tremendous strain on the departments and overworking the same people

- Any dedicated internal support should report into EVP of acquiring segment

- For a smaller deal, having the Integration Manager be the commercial lead (GM) would be optimal

- If we offer support, make sure it's allocated for enough time (6 months or longer)

- Dedicated resources would allow acquired employees to stay focused on their business

- Specifically need help with: HR, IT, Purchasing, Finance, Supply Chain, Compliance

- Need to make sure we have a sound governance structure with clear decision rights

- Establish centralized resources as a pivot point among all functions

- Need someone to outline best practices so we can build our solutions accordingly

Setting Expectations

- Acquirer senior management does not have a good understanding of the realities of integration

- Integration typically takes a year, so let's plan for that

- HR and Finance functions that require intense integration engagement. Need augmented resources - we are stretched to o thin (still responsible for "day job")

- Priority was on trying to meet a very aggressive valuation plan - making it easy to deprioritize integration efforts because the plan was overly aggressive

- Consider a "soak period" before starting full integration so we can better prepare: get the "gotta dos" done first

- Overly aggressive valuation puts everyone "behind plan" right off the bat which makes it hard to focus on integration

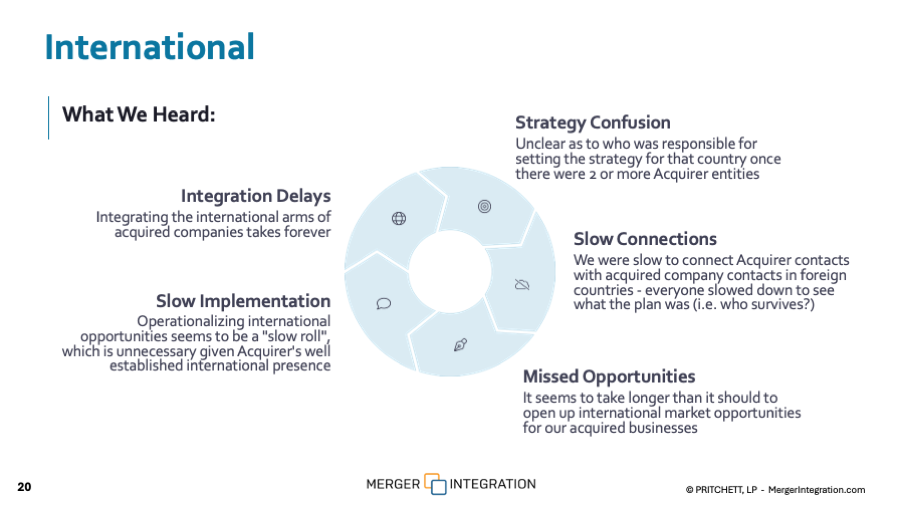

International

Strategy Confusion

Unclear as to who was responsible for setting the strategy for that country once there were 2 or more Acquirer entities

Integration Delays

Integrating the international arms of acquired companies takes forever

Slow Implementation

Operationalizing international opportunities seems to be a "slow roll" which is unnecessary given Acquirer's well established international presence

Slow Connections

We were slow to connect Acquirer contacts with acquired company contacts in foreign countries - everyone slowed down to see what the plan was (i.e. who survives?)

Missed Opportunities

It seems to take longer than it should to open up international market opportunities for our acquired businesses

Key Variables

- Size and sophistication of business

- Geographic reach

- Integration duration

- Size (revenue)

- Legacy ownership plan (stay or go)

- Communication channels

- Legacy systems stability and sophistication

- Ownership structure (e.g., family vs. PE)

- Centralized vs. decentralized acquired company business practices

Success Stories/Went Well

- Acquired Co. had a weekly integration related meeting where officers were invited

- Acquired Co. retention planning went well and resulted in no defections

- Acquirer continued local community involvement and that made a big difference to our employees

- People were made aware of potential career opportunities at Acquirer, which made them feel like they were now part of something bigger

Acquirer Strengths (positive changes we can make)

- Lower cost materials sourcing (Large vendor base to expand options)

- Incorporating Acquirer brand (e.g., signage on the building) helped people feel they were part of something bigger

- Financial support great - "if we need something we make a capital request and Acquirer takes care of it"

- Exposure to new markets for acquired company

Ideas from the Field

Ideas to Help Foster a "One Acquirer" and speed integration

- Operational, IT and Sales summits so peers can get together to exchange ideas and get to know each other

- Expose people to corporate campus - just visiting once had a profound affect on our sales team

- Prioritize email platform consolidation so it's easy to work together for simple things like scheduling a meeting