Gun Jumping Rules in M&A

Legal Requirements for Deals Subject to Regulatory Approval — No Jumping the Gun Prior to Close

- Neither company can attempt to exercise control over the other

- We cannot exchange competitively sensitive information

- We must operate as separate entities until the transaction closes

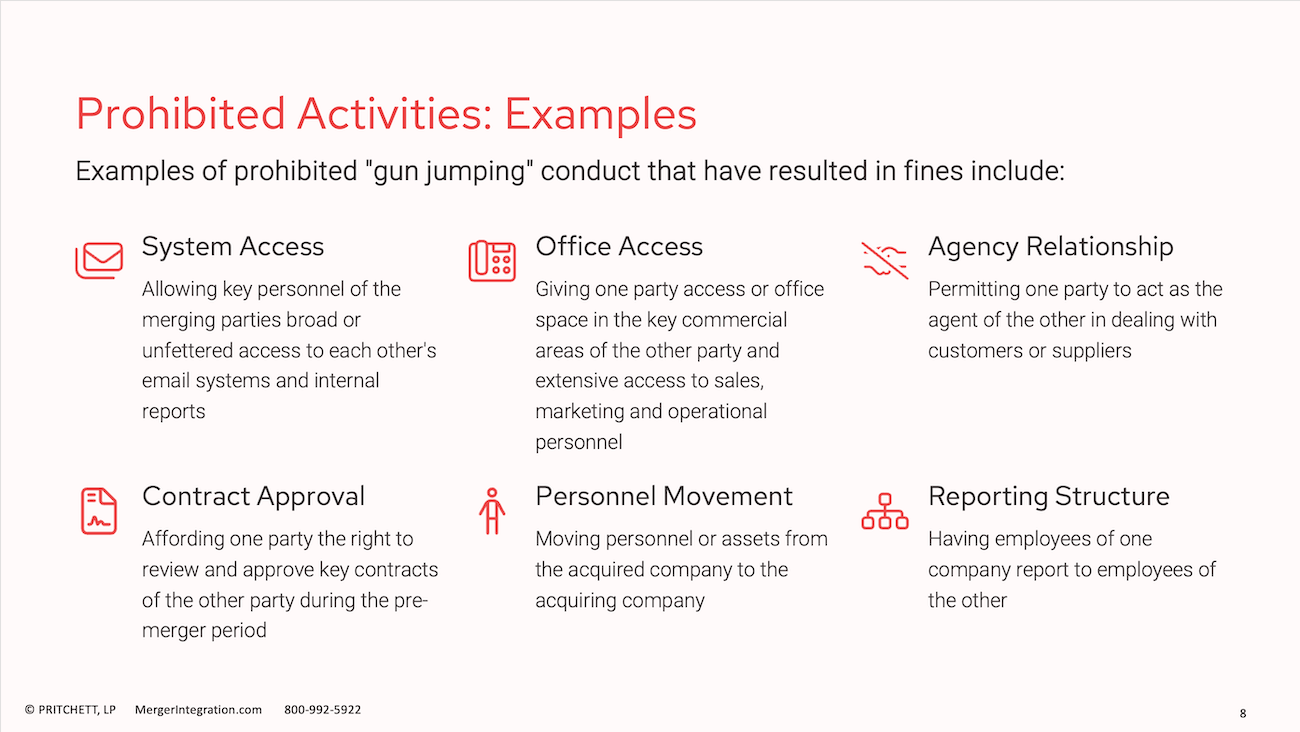

Examples of Prohibited Activities:

- No joint pricing, promotions, expansion plans (or influencing each other on these)

- No coordination on competitive practices, decisions or strategies

- Can’t participate in or influence each other’s day-to-day operations

- No joint decision-making on operational purchases or dispositions

- Acquirer employees cannot act on behalf of Target employees, nor vice versa

- No coordination on sales, purchasing or contracts with suppliers or vendors

- No division of customers or markets between the companies

- No implementation of integration plans prior to closing

- No broad unfettered access to each other’s systems (email, reports, etc)

- No access to office space or sales, marketing or operational personnel

Competitively Sensitive Information:

Before closing, an acquirer should not exchange competitively sensitive information with the other party. Examples of competitively sensitive information include:

- Current or future prices, price schedules, pricing policies, pricing plans or terms of sale

- Product-specific costs, including materials and third-party labor supply costs and national vendor contract terms

- Customer and product-specific prices, profitability, profit margins, discounts or rebates

- Vendor prices, profit margins, discounts or rebates

- Competitive strategies, including:

- Sales, bidding and marketing plans

- Specific harvesting plans

- Growth or expansion plans (including product and geographic markets)

- Other strategic plans

- Attempts to retain specific customers, land suppliers or materials/labor suppliers...

Activities Permitted Prior To Closing

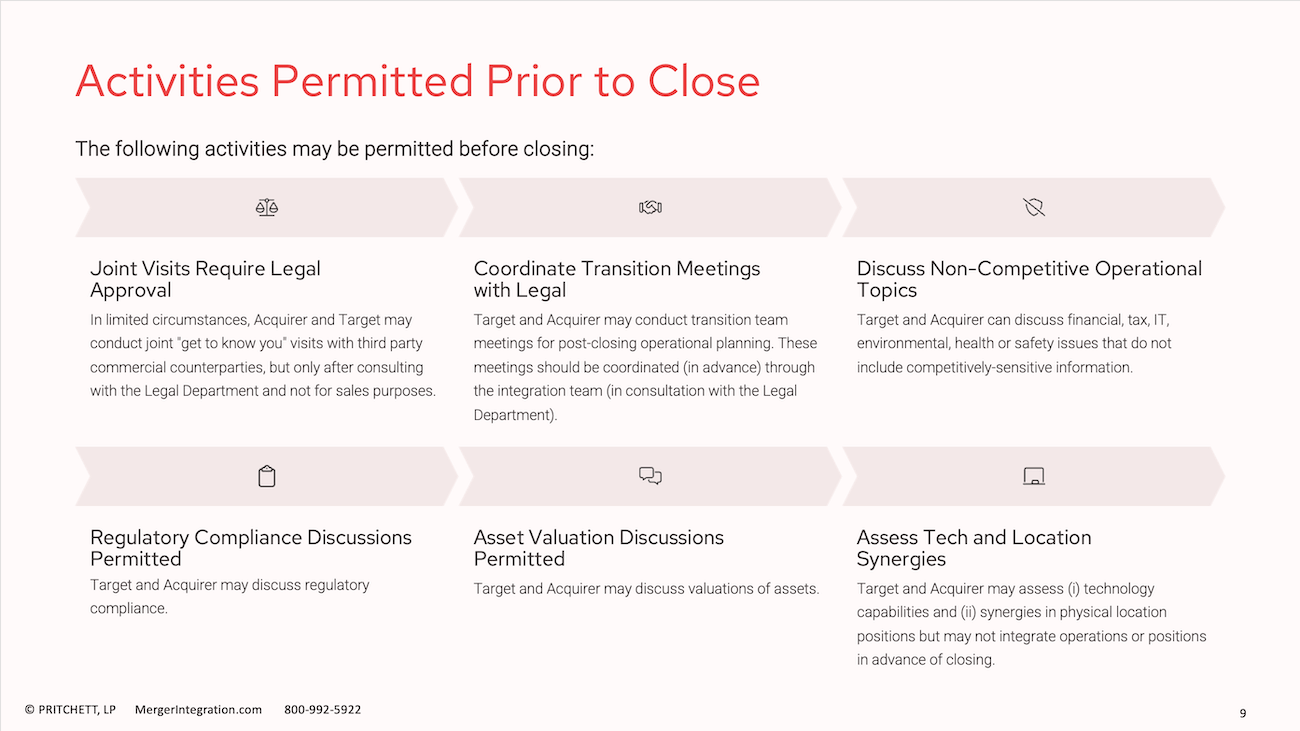

The following activities may be permitted before closing:

- Joint planning (but not implementation) of the combined company’s post-merger organizational structure

- Explaining respective compensation plans and employee benefits to each other

- Interviewing employees and assessing their qualifications for positions with the combined company post closing

- Conducting “get to know you” visits of people in similar functions

- In limited circumstances, holding joint “get to know you” visits with third-party commercial counterparties, but only after consulting with the Legal Department and not for sales purposes

- Conducting transition team meetings for post-closing operational planning (coordinated in advance through the integration team in consultation with the Legal Department)

- Discussing financial, tax, IT, environmental, health or safety issues that do not include competitively sensitive information

- Discussing regulatory compliance

- Discussing valuations of assets

- Assessing technology capabilities and synergies in operational positions, but not integrating operations or positions in advance of closing