Agenda

Five Takeaways From Our Last Meeting

Acquired Co. Differences with Acquired Company

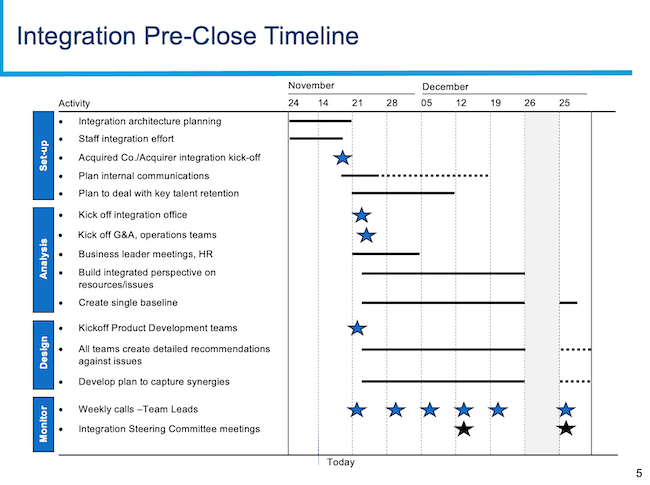

Timeline Pre-Close Timeline

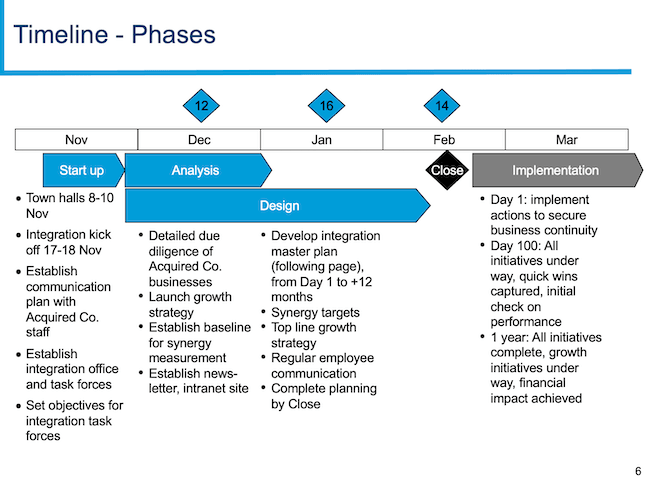

Timeline - Phases

Two Key Integration Deliverables

Agenda for Review with Steering Committee

Plans for Allocating Synergy Targets

Expectations of Team Members/Ground Rules

Key Success Factors for Integrations

Guiding Principles

Integration Planning Architecture

Integration Workstreams Governance

Team Calls – How We Want to Interact on a Regular Basis

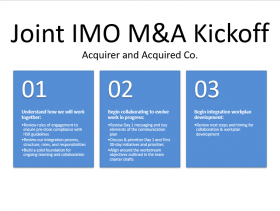

Kickoff Meeting Will be the First Interaction Between Acquirer and Acquired Co.

Teams Approach and Objectives of Team Discussion

Next Steps

Five Takeaways from Our Last Meeting

- Key Acquired Co. leaders participated

- Agreed on timelines and deliverables

- Agreed on what data can be shared and mechanism if unsure

- Assigned team leaders from Acquired Co.

- Learned more about the complexity of Acquired Co.

Acquired Co. Differences with Acquirer

- US Commercial structure broken out by business unit, but Europe managed as a whole

-

G&A organization and allocation are complex and need to be studied carefully

- Many G&A functions are Corporate

- Variety of allocation mechanisms exist, sometimes across divisions, and sometimes between corporate and a division

- Substantial allocation differences by site as well

- People retention issues an issue at Acquired Co.

Key Success Factors for Integrations

- Temporary structure does the integration planning work while the businesses continue to run

- Single leader for each team, with deputy from other company

- Use teams and sub-teams to focus work and allow parallel processing

- Timelines will be based on content of each area – each moves at a pace dictated by issues, opportunities

- Integration Management Office provides support to make teams successful

- Teams gather facts, evaluate options, and make recommendations

- The integration planning structure disappears after close though some teams on long-lead time items may remain ...