Objectives

Leverage Facility Strengths

Focus on Core Competencies

Reduce Costs

Eliminate Excess Capacity

Develop Lean Organization

Reduce Warranty Costs

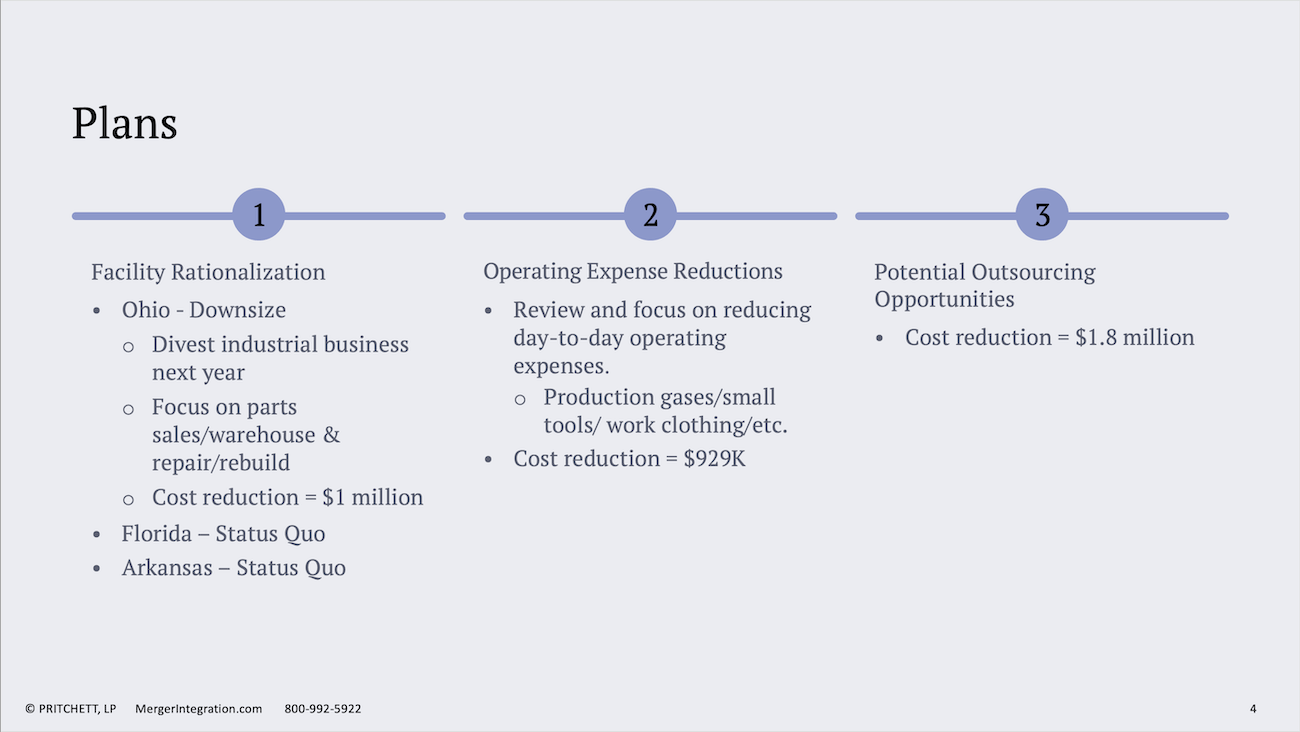

Integration Plans

1. Facility Rationalization

- Ohio: Downsize

- Divest: Industrial business next year

- Focus: Parts sales/warehouse

- Savings: $1 million

2. Operating Expense Reductions

Review and focus on reducing day-to-day operating expenses (e.g., production gases, small tools, work clothing).

Cost Reduction: $929K

3. Potential Outsourcing

Identify and pursue opportunities for outsourcing non-core functions to specialized vendors.

Cost Reduction: $1.8 million

Continued Improvements

Drive further cost reductions through continuous improvement initiatives.

Cost Reduction: $2.1 million (annualized $3.0 million)

Working Capital Reductions

Enhance inventory management, reduce lead times, and optimize schedule management.

Reduction: $2.2 million (Total Inventory Reduction $26 million)

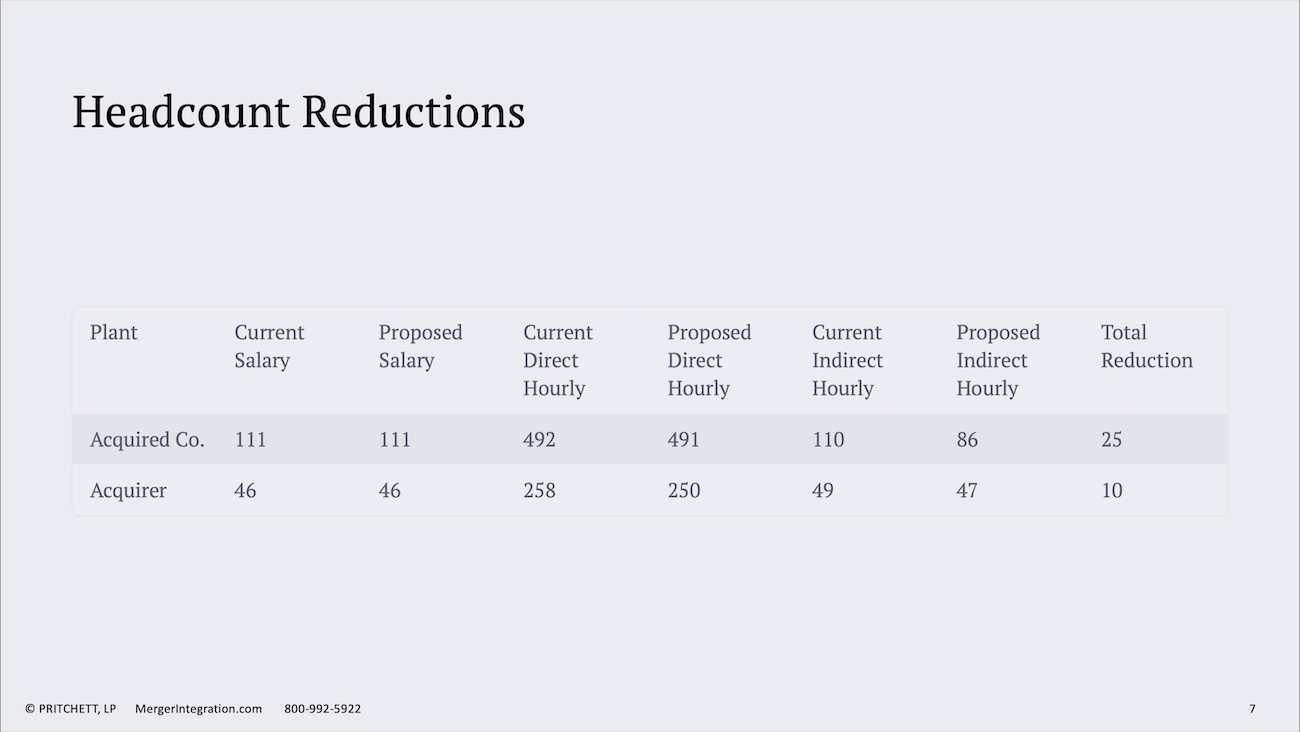

Headcount Reductions

| Plant | Current Salary | Proposed Salary | Current Direct Hourly | Proposed Direct Hourly | Current Indirect Hourly | Proposed Indirect Hourly | Total Reduction |

|---|---|---|---|---|---|---|---|

| Acquired Co. | 111 | 111 | 492 | 491 | 110 | 86 | 25 |

| Acquirer | 46 | 46 | 258 | 250 | 49 | 47 | 10 |

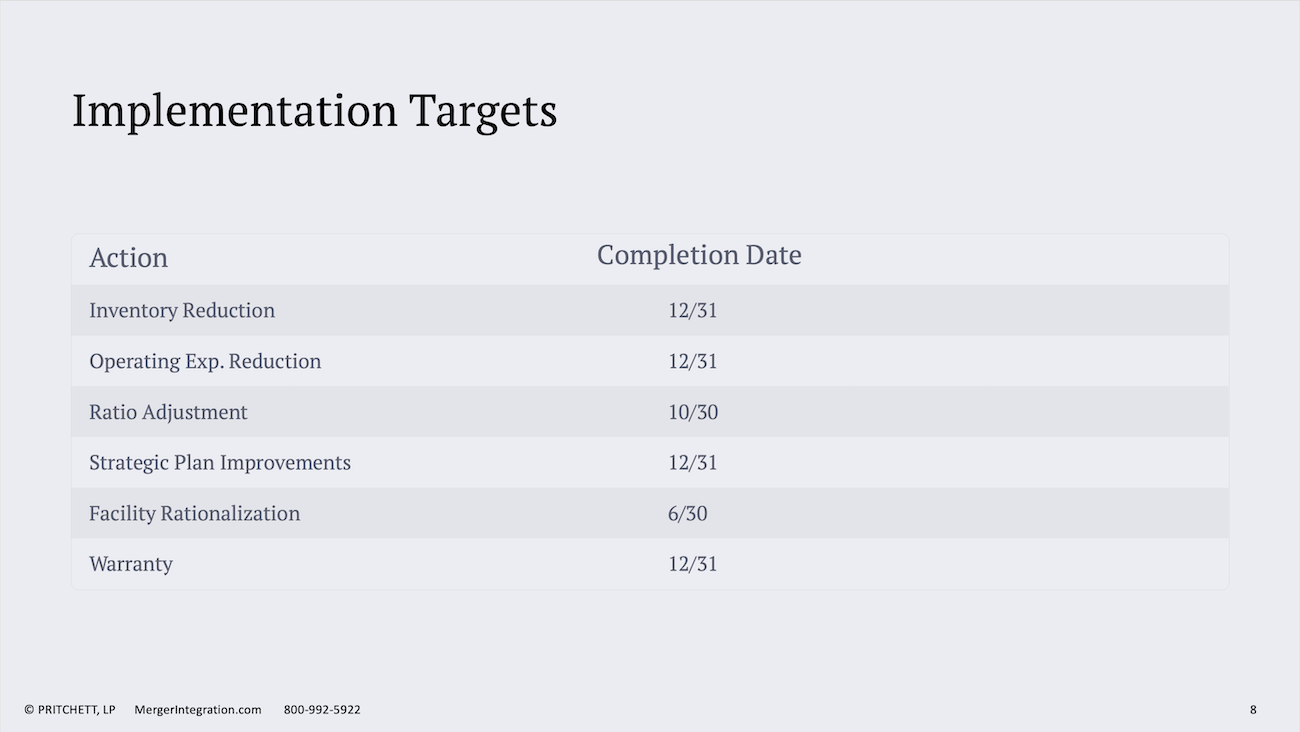

Implementation Targets

| Action | Completion Date |

|---|---|

| Inventory Reduction | 12/31 |

| Operating Exp. Reduction | 12/31 |

| Ratio Adjustment | 10/30 |

| Strategic Plan Improvements | 12/31 |

| Facility Rationalization | 6/30 |

| Warranty | 12/31 |

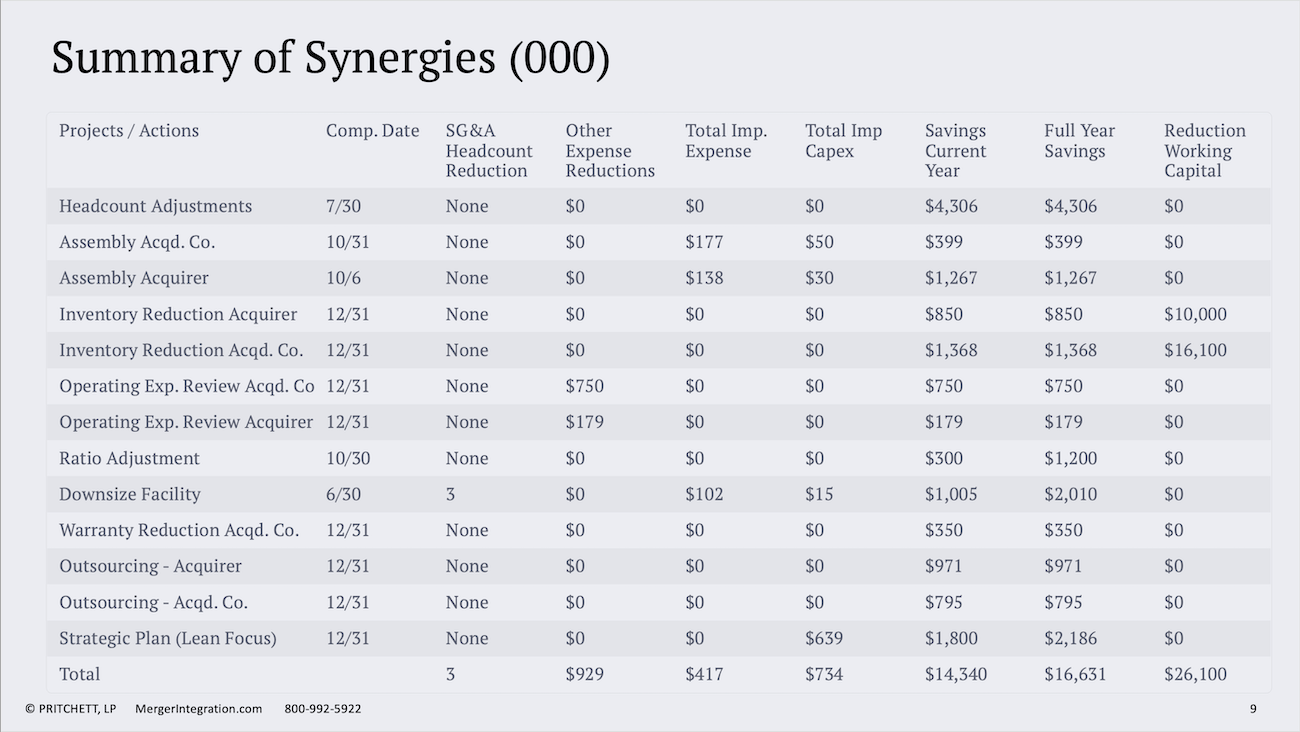

Summary of Synergies (in thousands)

| Projects / Actions | Comp. Date | Savings (Current Year) | Savings (Full Year) | Reduction Working Capital |

|---|---|---|---|---|

| Headcount Adjustments | 7/30 | $4,306 | $4,306 | $0 |

| Assembly Acqd. Co. | 10/31 | $399 | $399 | $0 |

| Assembly Acquirer | 10/6 | $1,267 | $1,267 | $0 |

| Inventory Reduction Acquirer | 12/31 | $850 | $850 | $10,000 |

| Inventory Reduction Acqd. Co. | 12/31 | $1,368 | $1,368 | $16,100 |

| Operating Exp. Review Acqd. Co | 12/31 | $750 | $750 | $0 |

| Operating Exp. Review Acquirer | 12/31 | $179 | $179 | $0 |

| Ratio Adjustment | 10/30 | $300 | $1,200 | $0 |

| Downsize Facility | 6/30 | $1,005 | $2,010 | $0 |

| Warranty Reduction Acqd. Co. | 12/31 | $350 | $350 | $0 |

| Outsourcing - Acquirer | 12/31 | $971 | $971 | $0 |

| Outsourcing - Acqd. Co. | 12/31 | $795 | $795 | $0 |

| Strategic Plan (Lean Focus) | 12/31 | $1,800 | $2,186 | $0 |

| Total | $14,340 | $16,631 | $26,100 |