Strategy of Deal

- Why did we buy this company?

- What is the strategic business objective?

- What are their strengths that can be leveraged?

Synergies

- Revenue gains or cost savings targets

- Time frame to reach targets

- Opportunities, constraints, or risks

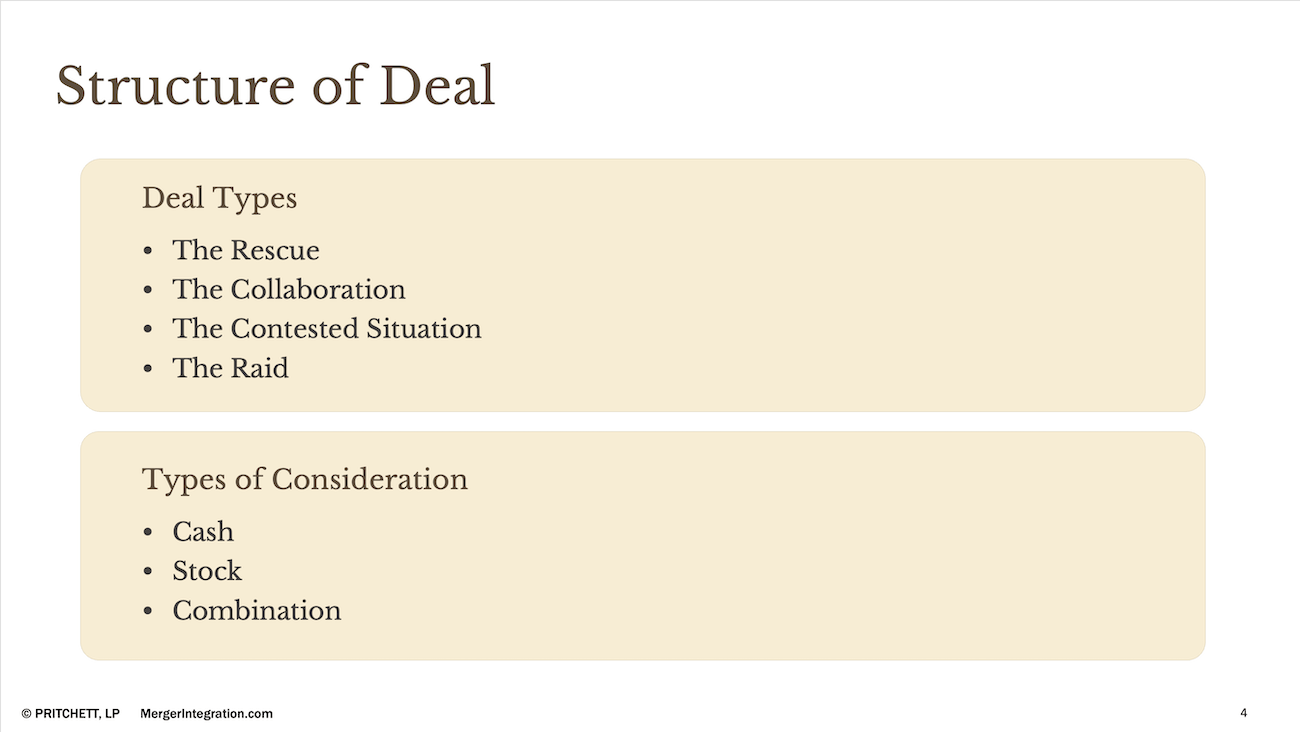

Structure of Deal

Deal Types

- The Rescue

- The Collaboration

- The Contested Situation

- The Raid

Types of Consideration

- Cash

- Stock

- Combination

Key Considerations

- Market Perception

- Target's Perception

- Align Communications

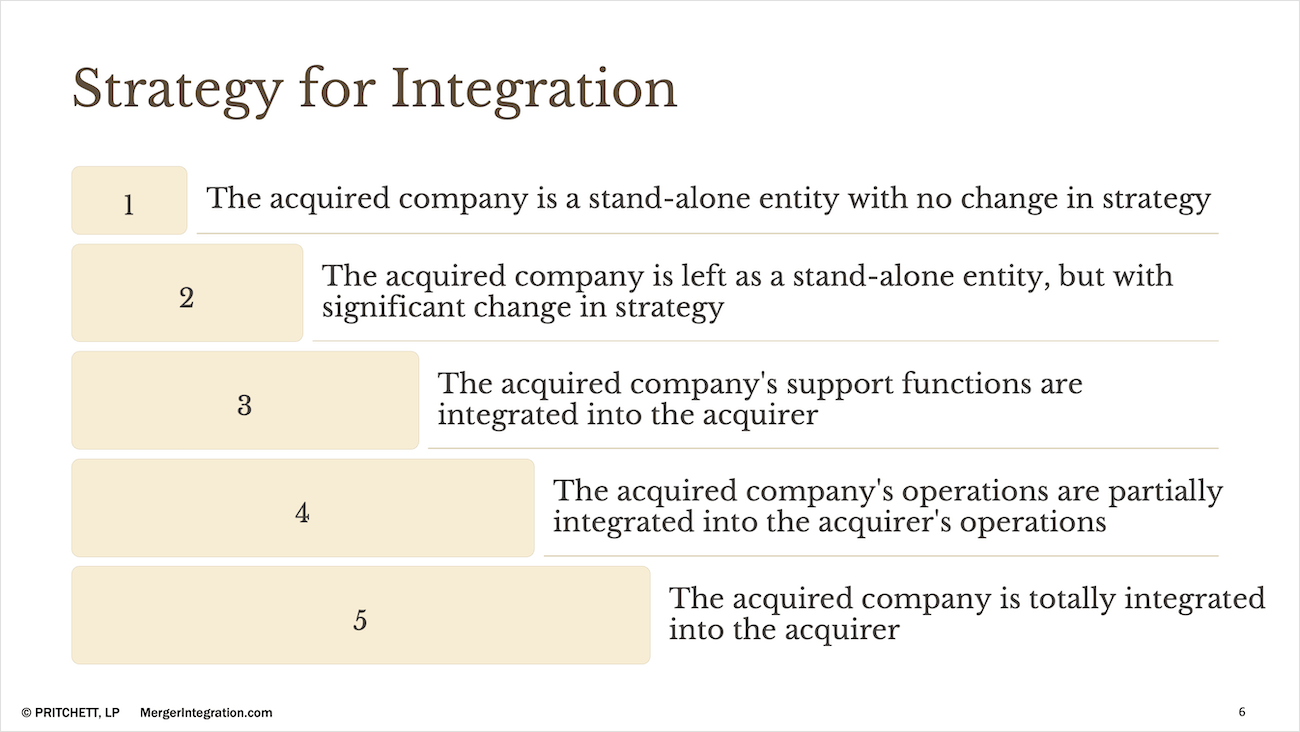

Strategy for Integration

- The acquired company is a stand-alone entity with no change in strategy.

- Left as stand-alone, but with significant change in strategy.

- Support functions are integrated into the acquirer.

- Operations are partially integrated into the acquirer's operations.

- The acquired company is totally integrated into the acquirer.