PRITCHETT’s five-day Due Diligence Certification Workshop teaches a well-defined methodology that streamlines and improves the quality of pre-deal investigations. Our attendees learn how to efficiently get to the truth on what truly matters. We help them develop a sixth sense, an ability to spot key issues that an untrained eye would overlook.

20 Reasons Why Our Workshop Helps Ensure Due Diligence Success

1. Foresight

Due diligence investigations, even very thorough ones, will not identify every acquisition risk. All acquirers endure at least a few post-merger “gotchas.”

Our M&A Due Diligence Certification Workshop shows attendees ways to see around the trickiest, most dangerous corners and avoid the most expensive surprises.

2. Portable

All due diligence examinations are different … and the same. While each is different, the underlying procedures for prioritization, issue resolution, scheduling, collaboration, resource allocation, risk management, and reporting remain the same. Our methodology focuses on the processes common to all deals. Acquirers can transport our tools and rules from one transaction to the next. They do not need to reinvent the wheel when they follow our proven approach.

3. Holistic

Sometimes specialists dive so deep into their own assigned areas of review that they lose sight of the big picture. Our training helps professionals view deals through a wider lens, one which cuts across functional disciplines such as corporate development, legal, human resources, accounting, sales and marketing, information technology, integration planning, strategy, and valuation.

When due diligence reviewers understand the meaning of the information gathered by other teams, they can more easily see an overarching, comprehensive view of the target company. An M&A specialist who clearly sees the forest, not only the trees, offers more enriched insights on a transaction.

4. Rigorous

As deal makers become more involved in a deal, they can lose a sense of distance and perspective. Sometimes, they even come down with acquisition fever—a desire to proceed with the transaction even in the face of mounting evidence that it should be ditched. We subject deals to tough, balanced reviews by respected decision makers, including operating managers, who weren’t involved in the initial stages of the acquisition process. Our system of formal checks and balances suppresses acquisition fever so a target’s valuation is more likely to be on the money.

5. Insightful

Many false but widely held beliefs undermine the effectiveness of due diligence programs. Our training program offers a fresh perspective, the hard truth.

Attendees learn why:

-

Most post-merger problems take root prior to close

-

Due diligence is the first phase of an integration

-

Financial statements are not the most valuable source of information

-

Due diligence can go too far

-

Great businesses can be awful investments

-

The true acquisition cost is not the acquisition price

-

Culture due diligence in the wrong hands does more harm than good

-

Examiners should turn over stones and ignore the rubble

-

The best acquirers can summon the courage to ditch a deal at the last minute

-

“Things” do not work themselves out naturally after close

6. Developed and Delivered by Experts

The professionals—M&A attorneys, investment bankers, and specialists in strategy, HR, IT, integration, and valuation—who teach our course also helped develop our methodology. They distilled the workshop’s best practices from thousands of hard-core M&A projects.

Our instructors have been around the block, in fact, many blocks in virtually all industries. They have seen it all - the good, the bad, and the ugly ... and the scary ugly. They share colorful stories on how M&A due diligence can reveal the best and worst in people and companies.

7. Fast

Due diligence reviewers must cover a lot of ground at a fast clip. We provide common data gathering templates, assessment instruments, procedures, reporting formats, and valuation models to accelerate the investigation process. Teams that use our tools can swiftly get their arms around potential synergies and integration challenges.

8. Diligent

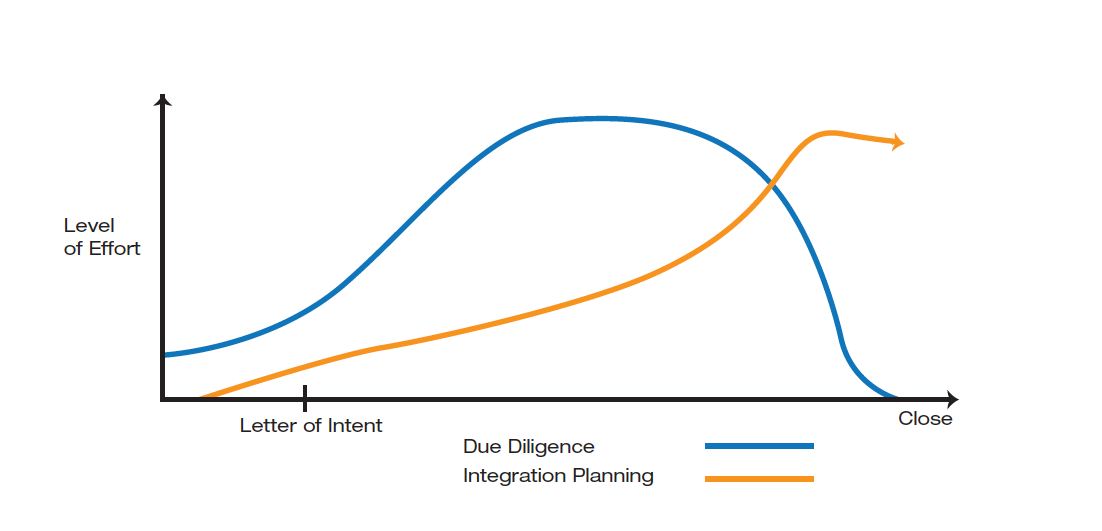

Integration planning should start before a deal closes to properly assess the level of difficulty in combining organizations. This planning process usually indicates, more accurately than due diligence alone, whether an acquirer and target will fit together or be like a round peg in a square hole.

The single best way for an acquirer to ensure a nice fit is to buy the right company.

9. Strategic

Acquirers almost always expect top-line growth from their acquisitions. Our sales and marketing examination process vets the assumptions underlying anticipated revenue gains. If the merged company’s projected growth rates do not hold up under scrutiny, then the logic for the acquisition probably does not either.

10. Top-Down and Objective-Driven

The answers to standard checklist questions are more likely to reveal whether a business looks good than whether it is a good investment. We instruct due diligence teams to prioritize inquiries based on the value drivers and potential pitfalls peculiar to each transaction. Our top-down targeted method, unlike a generic checklist approach, digs to the right depth on issues of material consequence to a deal.

11. Coordinated

As due diligence reviewers gather information from various sources, new questions will arise that trigger changes in the direction and depth of the investigation. Our approach includes mandatory, frequent, cross-functional meetings where teams share their notes and findings. A well-orchestrated collaboration process reduces the chances of people veering off on tangents and chasing the wrong priorities.

12. Efficient

Ever wonder why so many hard-nosed executives dismiss culture as a lightweight business matter? It’s because the vast majority of cultural issues are so inane. Think of them as “cultural noise.” In the overall scheme of corporate performance, they don’t carry any significant weight.

Meanwhile, a handful of culture characteristics wield make-or-break influence over a company’s future. Our methodology identifies the 5% of cultural factors that account for most of an organizations’ operating success and therefore warrant close examination. Acquirers should disregard cultural features too trivial to harm the bottom line.

13. Actionable

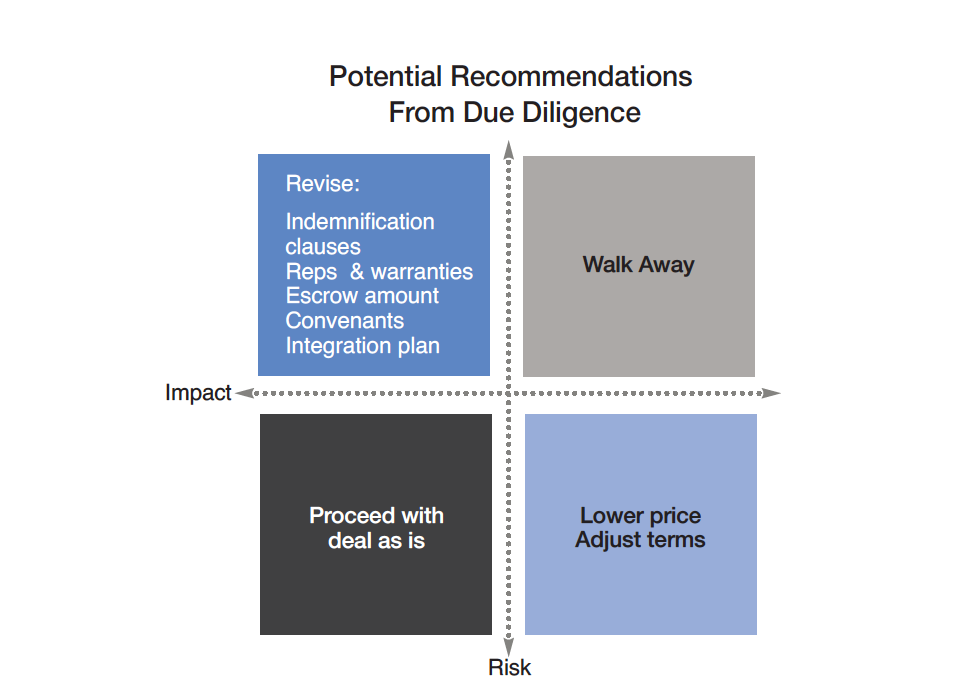

Typically, cultural assessments are a waste of time because acquirers don’t know what to do with the information they gather. Our training explains how to turn mission critical data into intelligence that feeds “go/no go” decisions, negotiations, valuations, and integration plans.

14. Clear

Our M&A Due Diligence Certification Workshop reduces the likelihood of post-merger misery and remorse. Attendees learn which actions under what circumstances will “derisk” deals. The best due diligence professionals address issues rather than merely identifying them.

15. Targeted

Initially, due diligence reviewers should cast a wide net because major risks may lie across a broad area. But they should quickly narrow their focus as they confirm or adjust their original assumptions.

Our training teaches participants what questions to ask in order to zero in on the issues pivotal to the deal’s success. We emphasize a targeted rather than sweeping approach to data collection. More information simply distracts when it’s meaningless minutiae.

Good due diligence requires knowing what materials to skip over so critical questions can be studied more carefully. A level of appropriate trust on trivial matters allows the time for a deeper exploration on key issues.

16. Balanced Perspective

Due diligence reviewers should search for both synergies and skeletons. Acquirers who focus on detecting only problems are using the due diligence process for a fraction of its promise. We train attendees how to discover strengths that can be leveraged–e.g., best practices, topnotch talent, and innovative processes. Sometimes, the richest opportunities are hidden gems that even the deal makers had not envisioned.

17. Optimization of Resources

Practically every business has some customers that exact concessions, soak up attention, and pay too little for what they receive. Our insightful methodology determines which target company customers should be given less consideration or phased out entirely, and which merit greater investments. Value can be created just by redeploying resources to more productive uses.

18. Objective

A critical and politically charged integration task is deciding how to staff a new combined company. We teach attendees how to develop a penetrating, objective assessment of strengths, weaker points, and potential of key players in merging organizations. Our instruction helps acquirers assign the right people to the right jobs quickly in a fair-minded, professional manner.

19. Thought Leadership

More than 1 million copies of our authors’ books have been sold. Each attendee receives the above titles.

Participant materials also include due diligence instruments, checklists, tools, road maps for effective use of findings, interview protocols, and reporting formats.

20. Backed by Hard Data

A New York Times article summed up the conventional wisdom on the success rates of corporate marriages:

“Most mergers fail. If that’s not a bona fide fact, plenty of smart people think it is. McKinsey and Company say it’s true. Harvard too. Booz Allen Hamilton, KPMG, A.T. Kearney, the list goes on. If a deal enriches an acquirers’ shareholders, the stats say it’s probably an accident.”

If this were true—if M&A were a loser’s game—why do CEOs continue to play it? Why do they still pursue acquisitions? Because they don’t buy into the gloom and doom. The failure statistics are grossly exaggerated. The majority of mergers do not destroy shareholder value.

Certain types of mergers at certain times, but not all mergers, are most likely to generate negative shareholder returns. In the workshop, we explain which deals are riskiest and where their areas of greatest vulnerability lie. Our insights are backed up by rock-solid, unbiased research.

Due Diligence Certification Workshop Agenda

Introduction

- Reviewing traditional practices in due diligence: a harsh critique

- Understanding the strategy/culture interface

- Examining the use and abuse of checklists

Staging the Due Diligence Process

- Clarifying the deal’s risks and value drivers

- Communicating explicitly the assumptions that underlie the transaction

- Selecting and prepping the due diligence teams

- Identifying what needs to be done, by when, and by whom

- Establishing materiality thresholds and deal-killer requirements

- Understanding the most common hidden risks

- Synchronizing culture analysis with the overall dealmaking/due diligence effort

- Creating the deal’s due diligence plan

The Mechanics of Due Diligence

- Focusing on the mission critical issues

- Using key data-gathering tools, techniques, and virtual data rooms

- Tailoring checklists for each area of review

- Walking the floor of the target’s operations

- Reviewing due diligence best practices by area (i.e. Accounting, Culture, Valuation, Legal, Sales and Marketing, Information Technology, Human Resources)

- Managing external resources

- Most common mistakes in gathering culture insights

Data Analysis/Actions

- Vetting strategic assumptions early in the process

- Reviewing documents to detect major risks

- Probing deep into areas of concern during interviews

- Getting past the B.S. and baloney

- Detecting culture traits that sabotage synergy goals

- “Know thyself”: The need to understand your own company’s culture

- Spotting value-creation opportunities

- Assessing the size, timing, and value of synergies

- Determining the stand–alone value of the target and walk-away price

- Consolidating data, making inferences, and drawing conclusions

- Providing insights that give deal makers a negotiating edge

- Advising the Integration Management Office (IMO) on sensitivities/priorities

- Translating due diligence findings into actions

- Capturing

Registration Info

Contact

For more information call PRITCHETT at 800-992-5922.

Location

The Due Diligence Workshop is conducted at client sites.