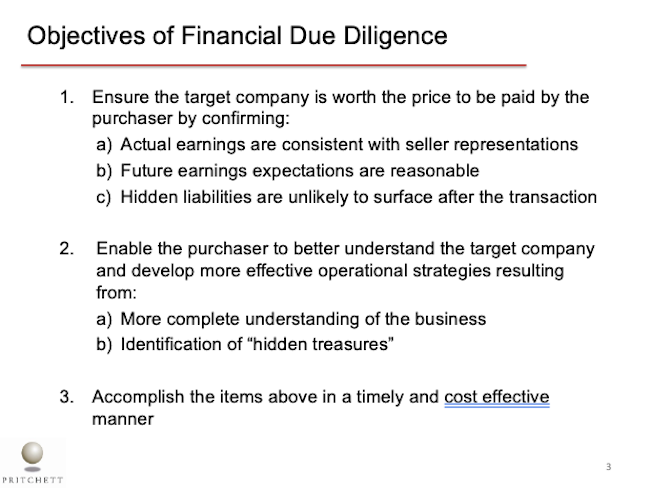

Three Objectives of Financial Due Diligence

- Ensure the target company is worth the price to be paid by the purchaser by confirming:

- Actual earnings are consistent with seller representations

- Future earnings expectations are reasonable

- Hidden liabilities are unlikely to surface after the transaction

- Enable the purchaser to better understand the target company and develop more effective operational strategies resulting from:

- More complete understanding of the business

- Identification of “hidden treasures”

- Accomplish the items above in a timely and cost-effective manner

Slide titles:

Financial M&A Due Diligence

The Heart of Business Value

Objectives of Financial Due Diligence

Efficient Due Diligence

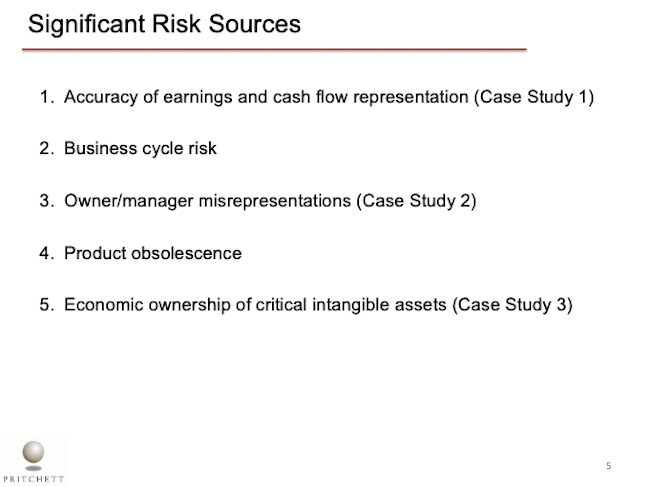

Significant Risk Sources

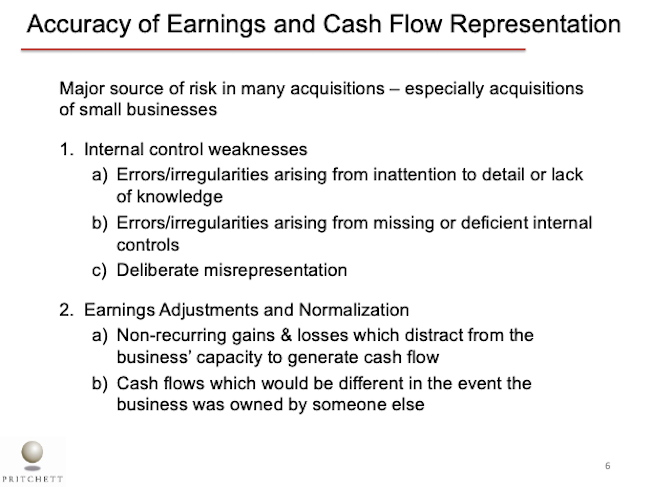

Accuracy of Earnings and Cash Flow Representation

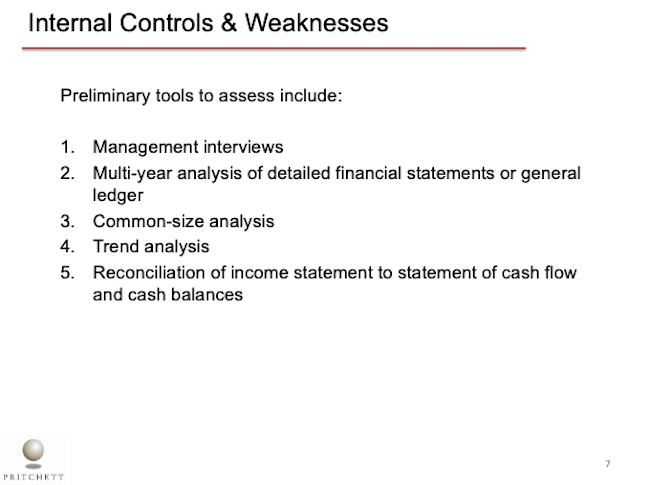

Internal Controls & Weaknesses

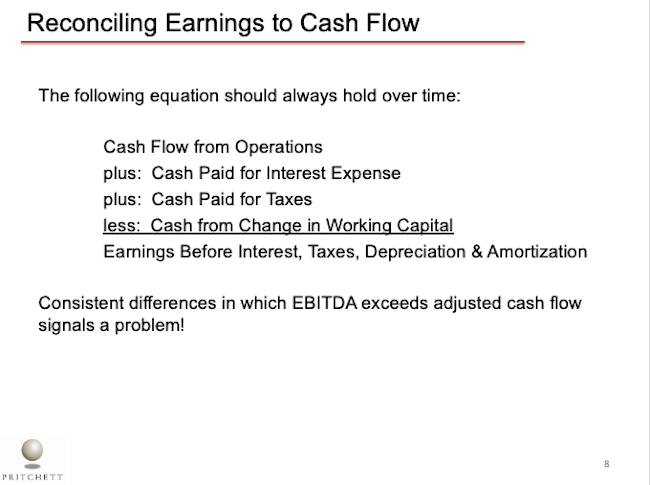

Reconciling Earnings to Cash Flow

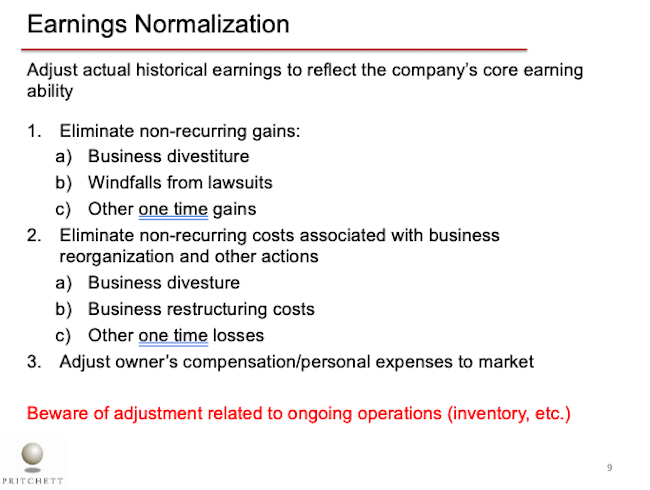

Earnings Normalization

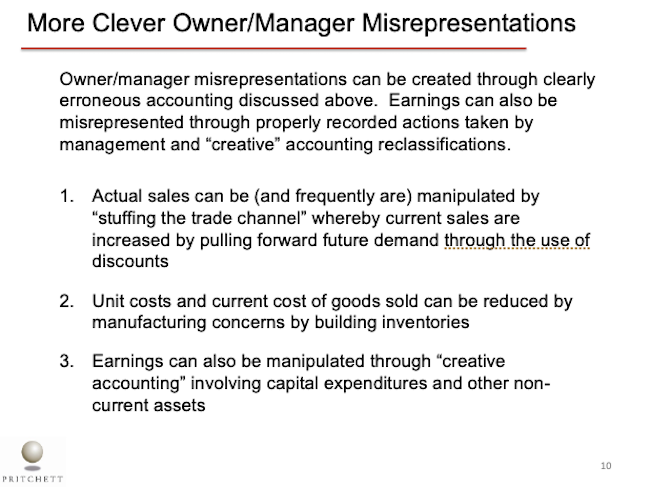

More Clever Owner/Manager Misrepresentations

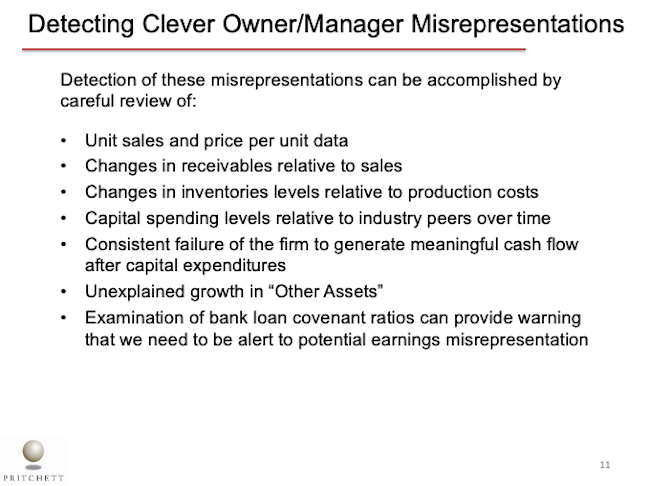

Detecting Clever Owner/Manager Misrepresentations

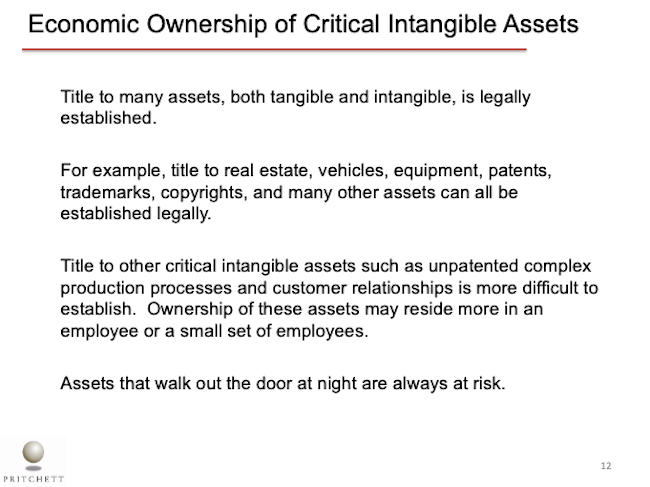

Economic Ownership of Critical Intangible Assets

Contact Information